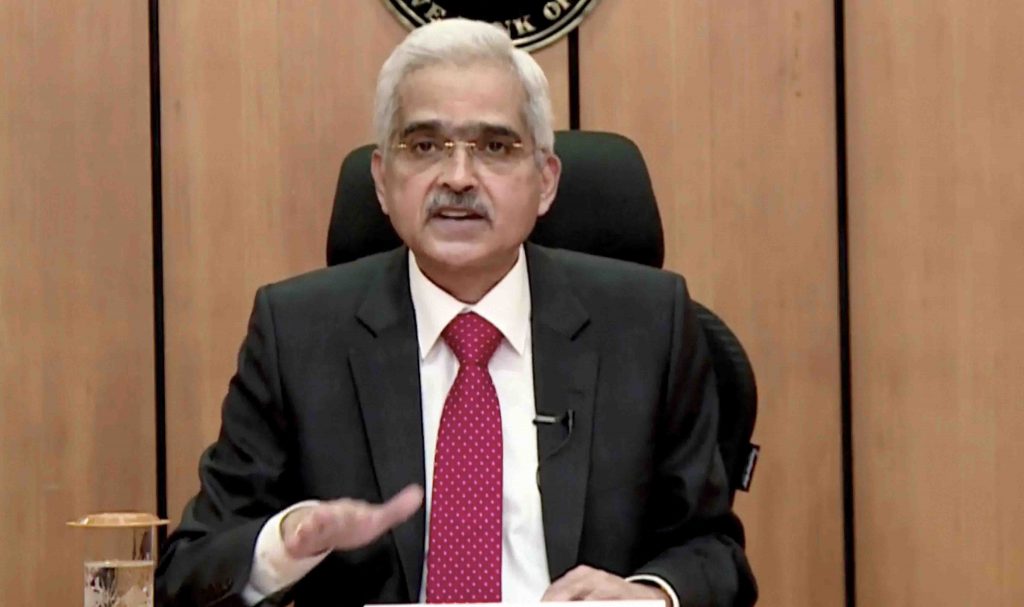

Mumbai: Nearly six years after the launch of the Unified Payments Interface (UPI), a new service which will enable over 40 crore feature phone users to access the popular digital transactions platform, was launched Tuesday by RBI Governor Shaktikanta Das.

The National Payments Corporation of India (NPCI), an RBI-promoted body which created and operates UPI, had launched a USD-based service to enable UPI access for feature phone users, within months of the launch of the main platform for smartphone users in 2016. However, the service was found to be cumbersome, not free and also not supported by all telcos, Deputy RBI Governor T Rabi Shankar said.

Shaktikanta Das rued that the multifaceted features of the UPI are available mostly on smartphones as of now. People from the lower rungs of society, especially in rural areas, are not able to access the payments service even as smartphones have become cheaper.

“The launch of UPI 123PAY makes facilities under UPI accessible to that section of society which has so far been excluded from the digital payments landscape. In that way, it is promoting great amount of financial inclusion in our economy,” Das said at a launch event at the central bank attended by officials from NPCI and banks.

Shaktikanta Das informed that the brand name derives from a three-step process required to initiate and execute a payment. Feature phone users will now be able to undertake a host of transactions based on four technology alternatives. They include calling an IVR (interactive voice response) number, app functionality in feature phones, missed call-based approach and also proximity sound-based payments.

Such users can initiate payments to friends and family, pay utility bills, recharge the FAST Tags of their vehicles, pay mobile bills and also allow users to check account balances, the RBI said. It added customers will also be able to link bank accounts, set or change UPI PINs.

Das said the overall quantum of transactions under UPI is growing very fast and has touched Rs 76 lakh crore in FY22 so far, as against Rs 41 lakh crore in FY21. In February alone, the volumes doubled to Rs 8.26 lakh crore through 453 crore transactions. “I don’t see a day when we are far away from reaching transaction volume of Rs 100 lakh crore on UPI,” Das stated.

Das expressed satisfaction that all the solutions being launched have been developed indigenously. He added that some of them have actually come out through the regulatory sandbox launched last year by the RBI to help test innovations in a controlled environment.

With the growth in the digital payments, Governor Das underlined the need to up the cybersecurity aspect. He added that ‘our systems have to be safe and available always’. Ensuring cybersecurity, customer satisfaction with transactions getting executed seamlessly and a strong grievance redressal mechanism should be the focus areas, he said.

Shaktikanta Das also urged the team members from NPCI to continue with the journey to take UPI to other countries to help the global community benefit from their innovations.