Mumbai: The government is working towards a single national sales tax rate which could be a mid-point between 12 and 18 per cent, Finance Minister Arun Jaitley said on Monday, in an effort to simplify the tax structure.

The government set the range for the Goods and Service Tax (GST) from 28 per cent to 5 per cent on most items when the signature reform was introduced last year.

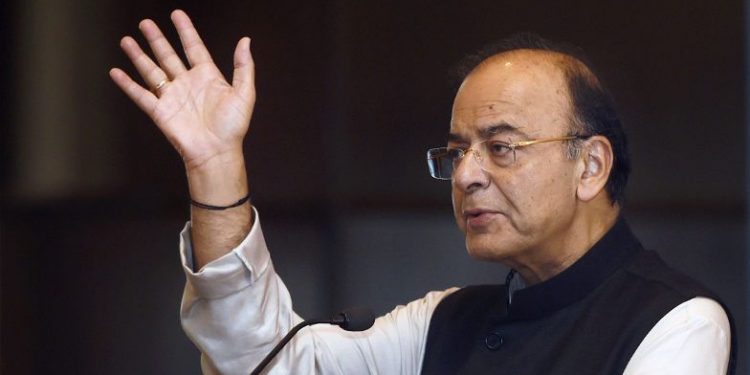

“Multiple slabs were fixed transiently in order to ensure the tax of no commodity goes up radically. This contained the inflation impact,” Jaitley wrote in his blog.

“A future road map could well be to work towards a single standard rate instead of two standard rates of 12 per cent and 18 per cent. It could be a rate at some mid-point between the two.”

He also said the country should look towards having slabs of zero, five per cent and a standard rate for luxury and sin goods (alcohol, drugs, cigarettes, etc.).

The government will also look at transferring cement into a lower tax slab as the next priority, he wrote.