Paris: Louis Vuitton owner LVMH has agreed to buy Tiffany for $16.2 billion in its biggest acquisition yet as the French luxury goods maker bets it can restore the iconic US jeweler’s luster. The $135-per share cash deal will boost LVMH’s smallest business, the jewelry and watch division that is already home to Bulgari and Tag Heuer, and help it expand in one of the fastest-growing sections of the industry.

Fashion and accessories brands including Christian Dior generate the bulk of earnings at LVMH, run by France’s richest man, Bernard Arnault, though growth in jewelry has shone in recent years. “The acquisition of Tiffany will strengthen LVMH’s position in jewelry and further increase its presence in the United States,” LVMH and Tiffany said in a joint statement.

LVMH shares opened up around 1.8% Monday and Tiffany’s Frankfurt-listed stock was up 6.6%. Tiffany CEO Alessandro Bogliolo said the transaction would “provide further support, resources and momentum.” The companies said they expected to close the deal in mid 2020.

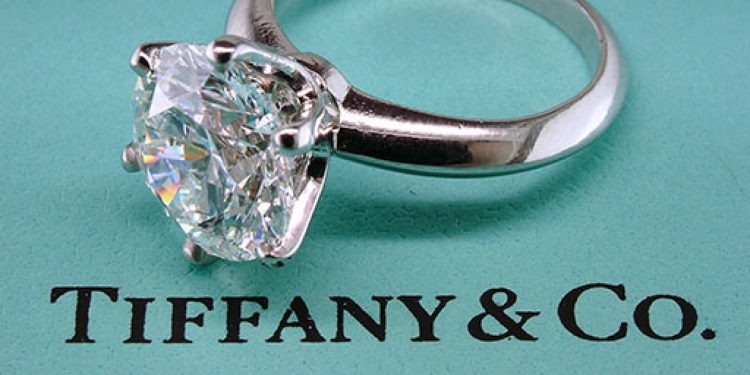

Tiffany said in the statement its board of directors recommended that shareholders approve the transaction with LVMH. The $135 price tag represents a 7.5% premium over Tiffany’s closing share level Friday, and is more than 50% higher than where the stock price stood before LVMH’s interest emerged. Founded in New York in 1837 and known for its signature robin’s egg blue packaging, Tiffany is one of the best-known names in the jewelry industry, and featured in the movie “Breakfast at Tiffany’s” starring Audrey Hepburn.