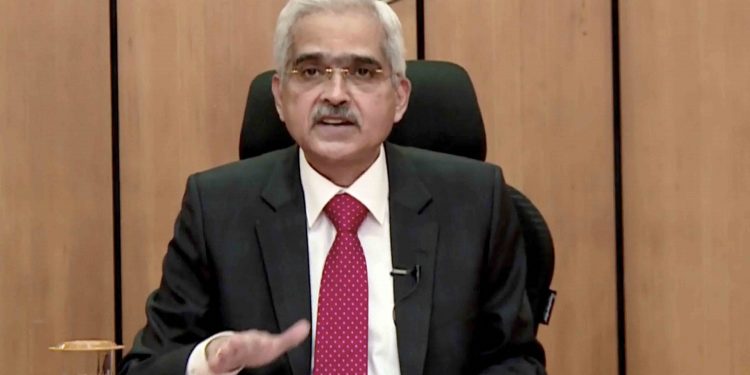

Mumbai: The Reserve Bank of India (RBI) decided Friday to leave benchmark interest rate unchanged at four per cent. However, the central bank maintained an accommodative stance as the economy faces heat of the second Covid wave. This is the sixth time in a row that the Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das has maintained status quo. RBI had last revised its policy rate May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rate to a historic low. MPC decided to maintain status quo, that is keeping benchmark repurchase (repo) rate at 4 per cent, Shaktikanta Das said. He was announcing the bi-monthly monetary policy review Friday. Consequently, the reverse repo rate will also continue to earn 3.35 per cent for banks for their deposits kept with RBI.

Das said MPC voted unanimously for keeping interest rate unchanged. It decided to continue with its accommodative stance as long as necessary to support growth and keep inflation within the target.

RBI lowered its estimate for economic growth to 9.5 per cent for the current fiscal from earlier projection of 10.5 per cent due to the impact of the second Covid-19 wave.

This is the first MPC meeting after official data showed that Indian economy contracted 7.3 per cent in the last fiscal. The economy was weighed down by nationwide lockdown that hit consumption and halted most economic activities.

Also read: Reserve Bank of India enhances scope of non-resident rupee accounts

With regard to inflation, Das said that retail inflation is likely to be 5.1 per cent during the current fiscal.

MPC has been given the mandate to maintain annual inflation at 4 per cent until March 31, 2026, with an upper tolerance of 6 per cent and a lower tolerance of 2 per cent, Das informed.

The RBI governor also said India’s forex reserves may have crossed record level of USD 600 billion on the back of robust capital flows. As per the RBI’s data issued May 28, India’s foreign exchange reserves rose by USD 2.865 billion to a record high of USD 592.894 billion for the week ended May 21. It was boosted by gold and currency assets.

“Based on the current estimation, we believe that our forex reserves may have crossed USD 600 billion,” Das said.

To boost liquidity, RBI announced several steps including a special liquidity facility for various sectors impacted by the Covid-19 pandemic.

The central bank also announced G-sec Acquisition Programme (G-SAP) 2.0 which will help in calming yields and control undue volatility faced by market participants in the government securities market.

During the second quarter of the current fiscal, the RBI said it will purchase Rs 1.20 lakh crore of G-sec from the secondary market, as part of G-SAP 2.0.