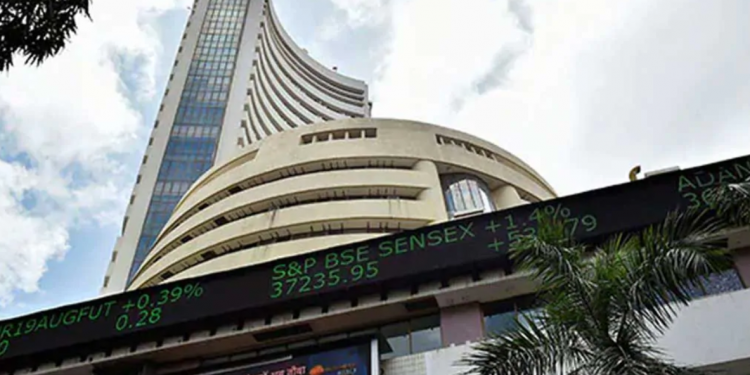

Mumbai: Equity benchmark Sensex declined over 120 points Monday, tracking losses in index heavyweights Reliance, SBI and HDFC twins amid a largely subdued trend in global markets.

The 30-share BSE index ended 123.53 points or 0.23 per cent lower at 52,852.27, while the broader NSE Nifty slipped 31.60 points or 0.20 per cent to 15,824.45.

SBI was the top loser in the Sensex pack, shedding over 1 per cent, followed by Reliance Industries, Tech Mahindra, M&M, L&T, Bharti Airtel, IndusInd Bank and HDFC.

On the other hand, Bajaj Finserv, UltraTech Cement, Sun Pharma, Titan, Tata Steel and Kotak Bank were among the gainers.

“Indian markets started marginally in red following negative Asian market cues as China tech and education shares plunged and Singapore’s manufacturing output declined 3 per cent in June on a seasonally adjusted, month-on-month basis.

“During the afternoon session markets swung between positive and negative territory with lacklustre trade as traders were concerned as foreign portfolio investors (FPIs) offloaded Indian equities to the tune of over Rs 5,689 crore in July so far as they continued to adopt a cautious stance in view of various domestic and global factors,” said Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers.

Also, the European stocks were seen retreating as investors watch corporate earnings, coronavirus cases and German business sentiment, which fell unexpectedly in July as supply chain constraints and rising COVID-19 infections dampened recent optimism, Solanki added.

Elsewhere in Asia, bourses in Shanghai, Hong Kong and Seoul ended with significant losses, while Tokyo closed in the green.

Equities in Europe were trading on a negative note in the mid-session deals.

Meanwhile, international oil benchmark Brent crude declined 0.34 per cent to USD 73.85 per barrel.

The rupee closed 2 paise lower at 74.42 (provisional) against the US dollar.

Foreign institutional investors (FIIs) were net sellers in the capital market as they offloaded shares worth Rs 163.31 crore Friday, as per provisional exchange data.