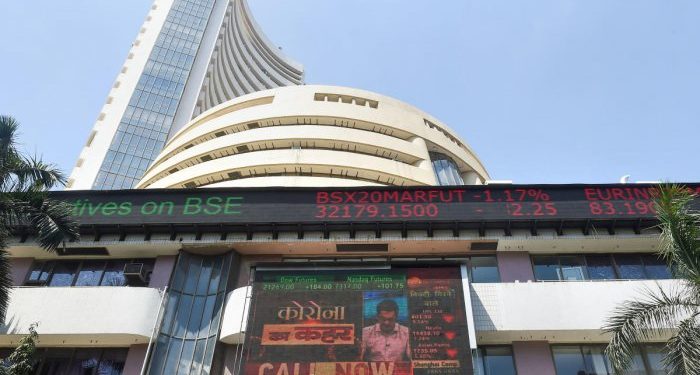

Mumbai: Equity benchmarks nursed losses for the third session on the trot Wednesday, weighed by banking, energy and auto stocks amid a lacklustre trend overseas.

Global markets stayed on the backfoot amid a continuing sell-off in Chinese shares, while investors also remained on the sidelines ahead of the US Federal Reserve’s policy decision.

After plummeting over 700 points in intra-day trade, the 30-share BSE Sensex clawed back some lost ground to end 135.05 points or 0.26 per cent lower at 52,443.71.

Similarly, the broader NSE Nifty slipped 37.05 points or 0.24 per cent to close at 15,709.40.

Kotak Bank was the top laggard in the Sensex pack, shedding 2.64 per cent, followed by Dr Reddy’s, M&M, PowerGrid, NTPC, HDFC Bank and Nestle India.

On the other hand, Bharti Airtel topped the gainers’ chart with a jump of 5.08 per cent after the telecom player hiked its prepaid tariffs, just a week after upgrading its postpaid plans.

Tata Steel, IndusInd Bank, Bajaj Finserv, ICICI Bank and UltraTech Cement were among the other winners, climbing up to 2.60 per cent.

“Domestic equities extended losses as weak cues from global markets triggered by selling pressure in Chinese tech stocks due to regulatory overhang weighed on sentiments,” said Binod Modi, Head Strategy at Reliance Securities.

Further, persistent selling pressure in financials led by concerns over asset quality dragged the benchmark index. However, positive cues from European markets and buy on dips helped market to recover from the day’s low in the second half, he added.

Vinod Nair, Head of Research at Geojit Financial Services, said, “Jitters over Chinese clampdown and wariness over ongoing Fed meeting outcome, continue to disturb the domestic market. However, as the global markets gained ground after the recent sell-off, losses were trimmed by the end of the day.”

“Due to a weak start to the sector earnings, pharma stocks continued to trade in bear’s grip while banking, auto and realty stocks were feeble too. Globally, the Fed’s comment on economic recovery, inflation and monetary policy may provide hints about tapering, which will determine the mood of the market in the near future,” he added.

Sectorally, BSE auto, bankex, utilities, realty, consumer durables and energy indices slipped up to 1.01 per cent, while telecom, metal, teck, basic materials and capital goods indices ended with gains. Broader BSE midcap index ended flat, while the smallcap gauge fell 0.45 per cent.

PTI