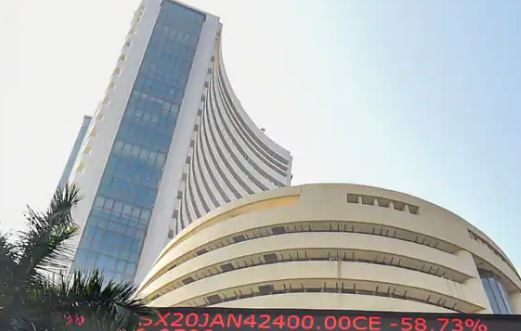

Mumbai: The BSE Sensex defied gravity for the second straight session Thursday, buoyed by across-the-board buying despite largely negative cues from global peers amid concerns over the Omicron strain of the coronavirus.

Building on a positive opening, the 30-share equity benchmark soared 776.50 points or 1.35 per cent to finish at 58,461.29.

On similar lines, the NSE Nifty surged 234.75 points or 1.37 per cent to 17,401.65.

HDFC was the top performer among the Sensex constituents, climbing 3.92 per cent, followed by PowerGrid, Sun Pharma, Tata Steel, Tech Mahindra, HCL Tech and Bajaj Auto.

Only three counters closed in the red — ICICI Bank, Axis Bank and UltraTech Cement, dipping up to 0.78 per cent.

“Irrespective of the weak sentiments in the international markets, domestic indices continued to rise due to gains in IT, financials and metal stocks amid strong domestic macroeconomic data,” said Vinod Nair, Head of Research at Geojit Financial Services.

Fed Chair’s remarks stating a possibility of a faster end to the bond-buying programme and interest rate hike along with the first confirmed case of the Omicron variant in the US, triggered a fresh global sell-off, he noted.

“The Union government’s fiscal deficit of 36.3 per cent of budget estimates in October, is better owing to improved revenue collection,” Nair added.

S Ranganathan, Head of Research at LKP Securities, said, “As the volatility index cooled off today, we witnessed stock-specific action across sectors in the broader markets buoyed by GDP and GST data together with cooling energy prices.”

All sectoral indices ended on a positive note, with BSE utilities, power, IT, teck, oil and gas, metal and finance indices advancing as much as 2.21 per cent.

Broader BSE midcap and smallcap indices jumped up to 1.12 per cent.

Wall Street led global markets lower after the US reported its first case of the Omicron variant as more countries imposed travel restrictions.

In Asia, bourses in Shanghai and Tokyo closed with losses, while Hong Kong and Seoul rose.

Stock exchanges in Europe were trading with losses in the afternoon session.

International oil benchmark Brent crude rose 2.41 per cent to USD 70.53 per barrel.

The rupee Thursday slipped 9 paise to close at 75.00against the US dollar as investor concerns grew over Omicron’s impact on the economy.

Foreign institutional investors remained net sellers in the capital market on Wednesday, as they offloaded shares worth Rs 2,765.84 crore, as per exchange data.

PTI