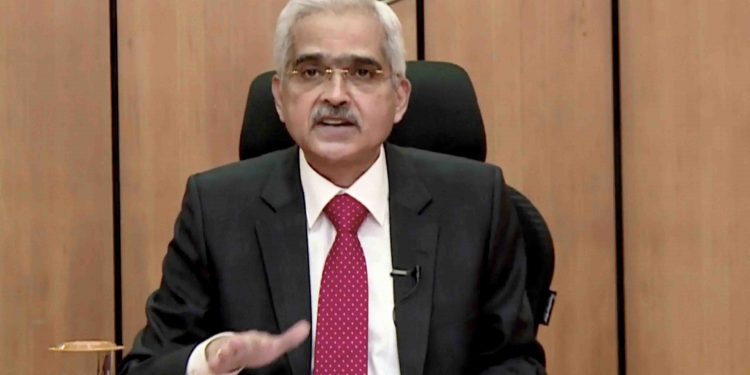

New Delhi: Reserve Bank of India (RBI) Governor Shaktikanta Das said Monday that the ‘momentum of inflation is on a downward slope’. He said the central bank would continue to strike a delicate balance between the need to contain price rise and ensure economic growth. The RBI’s inflation projections, Shaktikanta Das said, are ‘robust’ but contingent on downside and upside risks associated with the movement of global crude oil prices.

The RBI takes into account a particular range within which crude prices are expected to fluctuate considering all the factors that can be anticipated and that can be sort of foreseen as of today, Das said. He was responding to questions after the meeting of the RBI’s Central Board of Directors. The meeting was addressed by Finance Minister Nirmala Sitharaman.

Also read: RBI concerned over impact of cryptocurrency may have on financial stability: Shaktikanta Das

“… Our inflation projections… I would say it is quite robust and we stand by it. If there is something of course totally unforeseen and you know, which nobody can expect that is different and we have said that it is contingent on you know the risk the downside or the upside risk to these projections is the crude prices,” Das informed.

The RBI governor further said price stability, which basically means maintaining and adhering to the inflation target, is definitely uppermost in ‘our mind’ and the Reserve Bank is fully aware of its commitment to inflation, keeping in mind the objective of growth.

“… If you look at the momentum of inflation, right from October onwards, last October onwards, the momentum of inflation is on the downward slope,” Das pointed out.

He further said it is primarily the statistical reasons which has resulted in higher inflation, especially in the third quarter, and the same base effect will play in different ways in the coming months.

Last week, the RBI had said headline inflation is expected to peak in the fourth quarter of the 2021-22, within the tolerance band and then moderate closer to target in the second half of 2022-23, providing room for monetary policy to remain accommodative.

The government has tasked the RBI to keep Consumer Price Index (CPI) based inflation between 2-6 per cent.