New Delhi: India’s consumer price indexed inflation is expected to moderate in February 2022 from the levels in January, said Motilal Oswal Financial Services.

Notably, high commodities cost especially of transport fuel prices triggered a wider inflationary trend in January 2022. As a result, India’s main inflation gauge — Consumer Price Index (CPI) — which denotes retail inflation surged on a sequential as well as year-on-year basis.

The index rose to 6.01 per cent last month from 5.66 per cent in December 2021 and 4.06 per cent recorded for January 2021.

Accordingly, the retail inflation rate crossed the target range of the Reserve Bank of India.

The central bank has a CPI target range of 2-to-6 per cent.

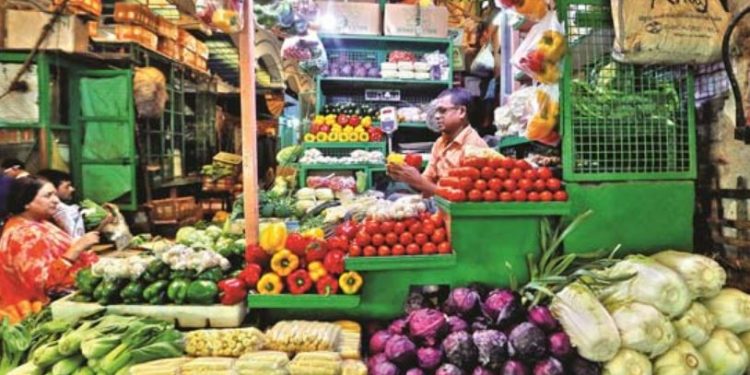

Besides, the rate of rise in the Consumer Food Price Index, which measures the changes in retail prices of food products, increased to 5.43 per cent last month from 4.05 per cent in December 2021.

“CPI is likely to have peaked out and may moderate to 5.7 per cent YoY in February 2022. Moreover, growth is a bigger concern in India right now rather than inflation,” said Motilal Oswal Financial Services.

“In fact, we expect real GDP to grow 5-5.5 per cent YoY versus the market consensus of 6 per cent. Accordingly, we believe monetary policy normalisation would be gradual in India.”

Furthermore, food inflation came in at a 14-month high of 5.4 per cent YoY in January 2022 versus 4 per cent YoY in December 2021 and 1.9 per cent YoY in January 2021.

“Within food, vegetables were the major cause of upward movement in prices; excluding vegetables, CPI came in at a nine month low of 6.1 per cent YoY in January 2022.”

“Other items such as cereals and products, pulses and products, eggs, meat and fish, milk and milk products, and spices – which constitute 25 per cent weight in the CPI index – also contributed to the higher inflation.”