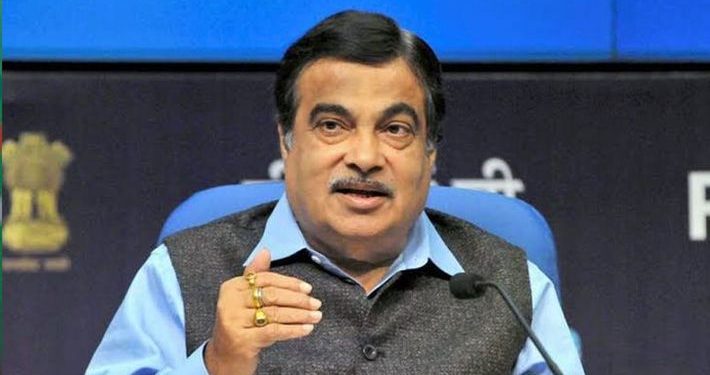

New Delhi: Union Road Transport and Highways Minister Nitin Gadkari Tuesday said infrastructure companies should also float their own non-banking financial companies (NBFCs) to fund road construction-related projects.

Gadkari further said the National Highways Authority of India (NHAI) should also have a financial arm like the Power Ministry’s Power Finance Corporation (PFC) or the Railways Ministry’s Indian Railways Finance Corporation (IRFC).

“Infrastructure companies are now investing huge money on infrastructure… Infrastructure companies should also float their own non-banking financial companies (NBFCs) to fund road construction related projects,” he said while speaking at an Assocham event.

He also suggested that NBFCs which will be floated to fund road projects, should tie up with foreign funds to reduce dollar hedging risk, and they can also mortgage toll rights.

Gadkari emphasised that there is a need to develop an innovative financial model for the highway sector as it is difficult to develop infrastructure only with the government money.

He also observed that the Ministry of Road Transport and Highways (MoRTH) has a road length of 1 lakh km, whose internal rate of return is more than 13 per cent.

According to the minister, MoRTH is also considering a proposal to set up a dedicated agency which will buy or restructure stalled projects.

He said due to the Ukraine-Russia war, inflation has increased.

The minister noted that some years back, road infrastructure related projects used to get delayed due to delay in land acquisition and environmental clearances.

“But now the situation has improved,” he said.

Gadkari asserted that India’s road infrastructure will be at par with the United States by 2024.

PTI