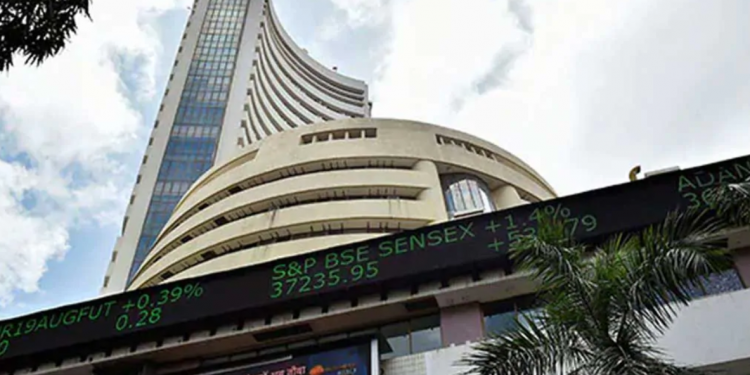

Mumbai: Equity benchmark indices went into a tailspin in early trade Friday, with the Sensex tumbling over 980 points to fall below the 55,000-mark, tracking an extremely weak global markets.

The 30-share BSE benchmark dived 980.45 points to 54,721.78 in early trade. The NSE Nifty also declined 300.15 points to 16,382.50.

All the Sensex pack firms were trading in the red, with Bajaj Finance, HCL Technologies, Bajaj Finserv, Maruti Suzuki India, Wipro, Axis Bank, Tata Steel and Infosys emerging as the major laggards in early trade.

Elsewhere in Asia, markets in Hong Kong, Shanghai and Korea were trading significantly lower, while Tokyo quoted marginally higher.

Stock exchanges in the US had fallen sharply in the overnight trade on Thursday.

“US markets witnessed a relief rally on Wednesday after FOMC meeting but it tumbled on Thursday due to more anxiety over rising interest rates. Asian markets are trading in the red in early Friday trade,” said Mohit Nigam, Head – PMS, Hem Securities.

On Thursday, the BSE benchmark closed just 33.20 points or 0.06 per cent higher at 55,702.23. Similarly, the NSE Nifty inched up 5.05 points or 0.03 per cent to 16,682.65.

Meanwhile, international oil benchmark Brent crude jumped 0.45 per cent to USD 111.40 per barrel.

Foreign institutional investors again offloaded shares worth Rs 2,074.74 crore on Thursday, according to stock exchange data.

“While intra-day volatility will continue, markets will keep an eye on Reliance Industries’ earnings scheduled to be announced later today. With most of the negative factors in play, FII selling has once again picked up, as overseas investors sold shares worth Rs 2,074.74 crore Thursday,” said Prashanth Tapse, Vice President (Research), Mehta Equities Ltd.