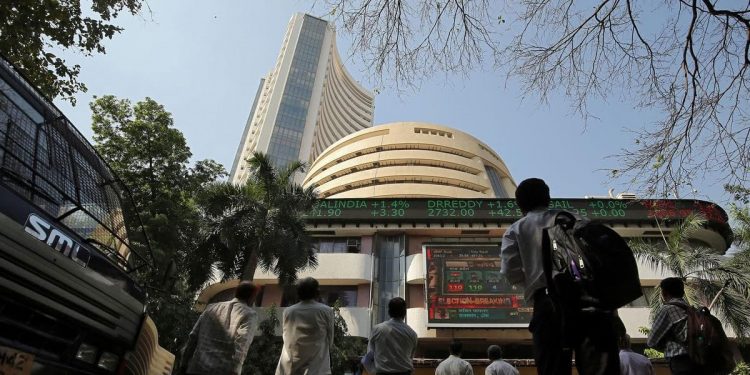

Mumbai: Equity benchmark indices Sensex and Nifty ended lower in highly volatile trade on Thursday due to selling in banking, metal, and energy counters amid a mixed trend in the global markets.

Falling for the second day in a row, the 30-share BSE Sensex declined 193.70 points or 0.31 per cent to settle at 62,428.54 even after a positive beginning. During the day, it fell 263.1 points or 0.42 per cent to 62,359.14.

The NSE Nifty fell 46.65 points or 0.25 per cent to finish at 18,487.75.

From the Sensex pack, Bharti Airtel fell by 3.42 and Kotak Mahindra Bank declined 3.31 per cent. ICICI Bank, ITC, HDFC Bank, UltraTech Cement, HCL Technologies, and Maruti were the other major laggards.

Tata Motors, Hindustan Unilever, Asian Paints, Sun Pharma, Nestle, Tata Consultancy Services, Wipro, Bajaj Finance, Axis Bank, and IndusInd Bank were among the gainers.

In Asian markets, Seoul and Hong Kong ended lower, while Tokyo and Shanghai settled in the green.

Equity markets in Europe were trading in positive territory. The US markets ended lower Wednesday.

Firing on all cylinders, India continues to maintain its streak of world-beating economic growth after GDP for the March quarter beat all expectations with a 6.1 per cent expansion that helped push the annual growth rate to 7.2 per cent.

Global oil benchmark Brent crude dipped 0.17 per cent to USD 72.48 a barrel.

Foreign Institutional Investors (FIIs) continued to remain, net buyers, as they bought equities worth Rs 3,405.90 crore Wednesday, according to exchange data.

In the US, veering away from a default crisis, the House approved a debt ceiling and budget cuts package late Wednesday, as President Joe Biden and Speaker Kevin McCarthy assembled a bipartisan coalition of centrist Democrats and Republicans against fierce conservative blowback and progressive dissent.