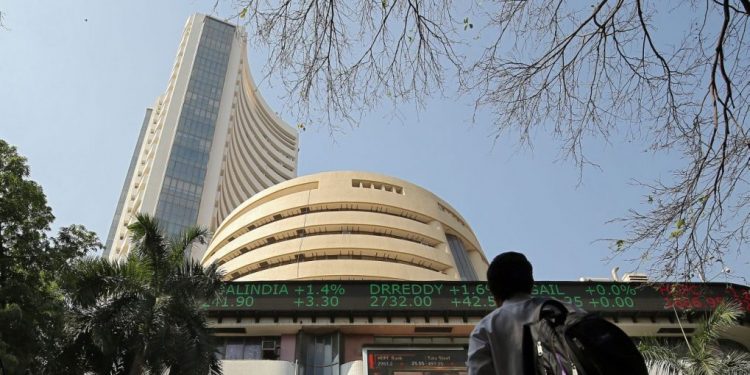

Mumbai: Benchmark equity indices climbed nearly 1 per cent Wednesday on buying in HDFC Bank and Reliance Industries.

Investors are eyeing the two important events lined up ahead — the interim budget and the US Fed interest rate decision — to derive further cues from.

Recovering all the early lost ground, the 30-share BSE Sensex jumped 612.21 points or 0.86 per cent to settle at 71,752.11. During the day, it zoomed 711.49 points or 1 per cent to 71,851.39.

The Nifty climbed 203.60 points or 0.95 per cent to 21,725.70.

Among the Sensex firms, Sun Pharma, Tata Motors, State Bank of India, Mahindra & Mahindra, Maruti, Bajaj Finserv, Power Grid and UltraTech Cement were the major gainers.

Larsen & Toubro declined over 4 per cent after its December quarter earnings. Titan also ended lower from the 30-share pack.

In Asian markets, Tokyo, Shanghai and Hong Kong ended lower while Seoul settled in the green.

European markets were trading on a mixed note. The US markets ended mostly down Tuesday.

“A positive build-up was reflected in Indian markets prior to the interim budget, although expectations are low, the market anticipates a lower fiscal deficit supported by buoyant tax revenues. The overall trend in the market is akin to a see-saw, and the buy-on-dips strategy is effective as of now. Global market cues are mixed ahead of the FOMC meeting, and US 10-year yields were marginally down,” said Vinod Nair, Head of Research, Geojit Financial Services.

Global oil benchmark Brent crude declined 0.91 per cent to $82.12 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,970.52 crore Tuesday, according to exchange data.

The BSE benchmark fell by 801.67 points or 1.11 per cent to settle at 71,139.90 Tuesday. The Nifty declined 215.50 points or 0.99 per cent to 21,522.10.

PTI