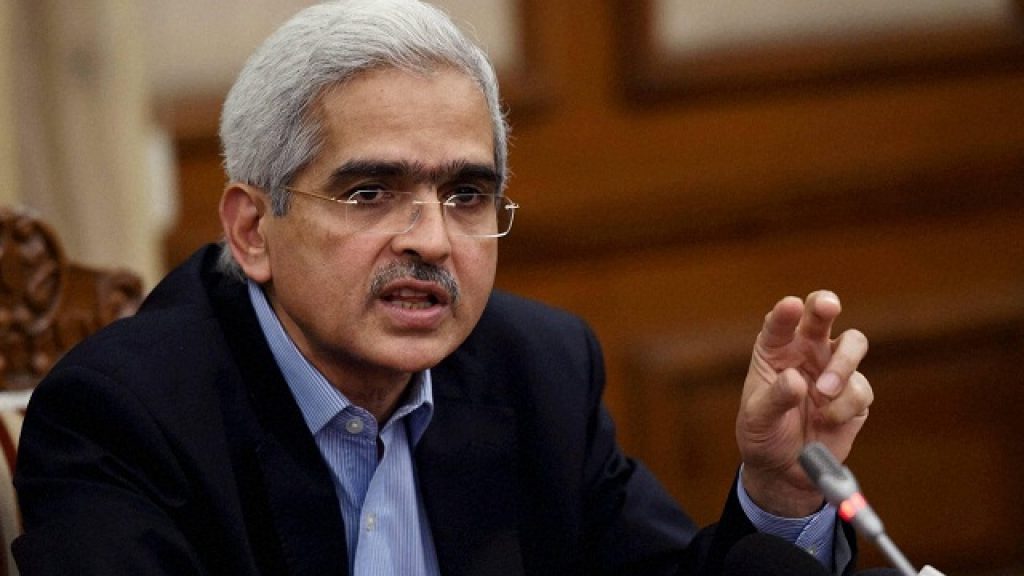

New Delhi: Reserve Bank of India Governor Shaktikanta Das has said four banks under the Prompt Corrective Action (PCA) framework are taking efforts and they are being monitored.

Currently, Indian Overseas Bank (IOB), Central Bank of India, UCO Bank and United Bank of India are under this framework, which puts several restrictions on them, including on lending, management compensation and directors’ fees.

“We would like them to improve their performance and come out of PCA as quickly as possible. We are engaged with the banks. We are monitoring it. They are taking efforts. Banks are required to take several actions to come out of the PCA, and that is being monitored,” Das told PTI in an interview.

Recently, the government announced capital infusion of Rs 11,521 crore into these four banks, with IOB getting the highest amount of Rs 4,360 crore. Central Bank of India got Rs 3,353 crore, UCO Bank Rs 2,142 crore and United Bank of India Rs 1,666 crore.

Besides, LIC-controlled IDBI Bank too received additional capital of Rs 4,557 crore through the first supplementary demands for grants approved by Parliament in December.

Last year, the RBI removed five banks — Bank of India, Bank of Maharashtra, Oriental Bank of Commerce, Allahabad Bank and Corporation Bank — from the PCA framework in two phases after capital support from the government that resulted in improvement in their financial parameters.

The capital infusion helped these lenders meet requisite capital thresholds and reduce their net NPA levels to below 6 per cent.

Out of the 11 banks put under the PCA framework last year, Dena Bank ceased to exist as a separate entity after its merger with Bank of Baroda in April, while IDBI Bank has been acquired by LIC.

With regard to the proposed mega merger of public sector banks announced by the government, the governor said, the RBI has advised the lenders to take special measures to ensure that the normal activities do not face any disruption.

“The normal activity in terms of loan sanction in terms of recoveries and other activities are affected because of the merger process. So, and we are monitoring that, we will monitor that,” he said.

Last year in August, the government announced the consolidation of ten public sector banks (PSBs) into four mega state-owned lenders. As per the plan, United Bank of India and Oriental Bank of Commerce would merge with Punjab National Bank, making the proposed entity the second largest public sector bank (PSB).

It was decided to merge Syndicate Bank with Canara Bank, while Allahabad Bank with Indian Bank. Similarly, Andhra Bank and Corporation Bank are to be consolidated with Union Bank of India.

In April 2019, Bank of Baroda in a first three-way merger exercise amalgamated Vijaya Bank and Dena Bank with itself. The SBI had merged five of its associate banks – State Bank of Patiala, State Bank of Bikaner and Jaipur, State Bank of Mysore, State Bank of Travancore and State Bank of Hyderabad and also Bharatiya Mahila Bank with itself effective April 2017.

(PTI)