New Delhi: Asserting that “alarm bells” are ringing in the Indian economy, the Congress Tuesday claimed stagnant wages and high inflation have forced households to take loans just to get by and are slowly sinking into debt.

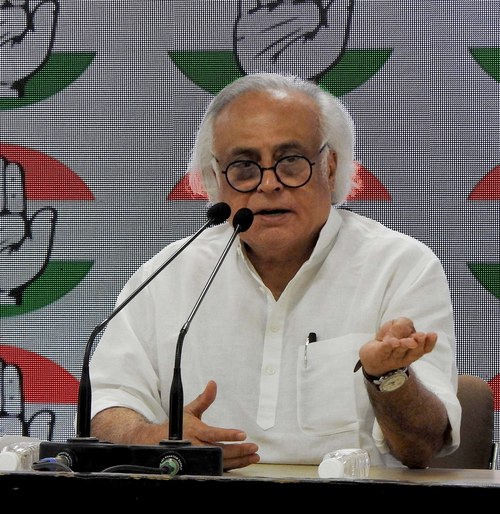

Congress general secretary Jairam Ramesh also stressed that the Congress’ ‘Nyay Patra’ is a direct response to the “failures” of the government and said “dus saal anyay kaal” ends June 4.

“All the alarm bells are ringing in the Indian economy, only Mr. Modi does not seem to hear them. Under his leadership, India has witnessed record levels of unemployment, high inflation, declining real wages, widespread rural distress, and dramatic increases in inequality,” Ramesh said in a statement.

He said the latest report from a leading financial services company shows the devastating impact that Modi’s policies have had on Indian households.

“According to the report, household debt levels reached an all-time high of 40% of Gross Domestic Product (GDP) by December 2023. Furthermore, at 5% of GDP, net financial savings have also dropped to their lowest level in 47 years!” he said, referring to the report that has appeared in the Business Standard.

The report states that this “dramatic” fall in savings is due to weak income growth, which explains why both private consumption and household investment growth have remained markedly subdued in 2023-24, Ramesh said.

“The authors make sure to point out that the ‘dismal’ savings rate is ‘not an anomaly’, and that net financial savings have remained at 5% of GDP for the first nine months of 2023-24. Reduced savings means less capital available for business and government investments, and increased reliance on volatile foreign capital,” he said.

The report also confirms that a spike in unsecured personal loans is to blame for high levels of household debt, not home loans or vehicle loans as the Finance Ministry would have us believe, he said.

“The share of housing in personal loans is actually below 50% for the first time in 5 years, and only high-end automobiles are doing well, while mass market cars and 2-wheeler sales have slumped,” the Congress leader argued.

“December also saw a worrying surge in gold loans – given the sentimental value that households place on gold assets such as jewelry, these loans are only taken as a last resort. Although the Modi Sarkar would be loath to admit it, the fact is that stagnant wages and high inflation have forced households to take loans just to get by,” Ramesh said.

The finance ministry can spin this all they want but the truth is there for everyone to see – far from saving money, Indian households are slowly sinking into debt, he claimed.

“The findings of this report add to the laundry list of the Modi government’s economic failures: Near-zero growth in employment – just 0.01% jobs added between 2012 and 2019, while 70-80 lakh youths join the labour force every year. Real wages of regular workers have declined between 2012 and 2022. Due to high inflation, workers can now afford less than they could ten years ago,” he said.

Ramesh said MGNREGA person-days increased from 265 crore in FY2022-23 to 305 crore in FY 2023-24, indicating widespread rural distress.

The seven-phase Lok Sabha polls will begin April 19 and end June 1. The results will be declared June 4.

PTI