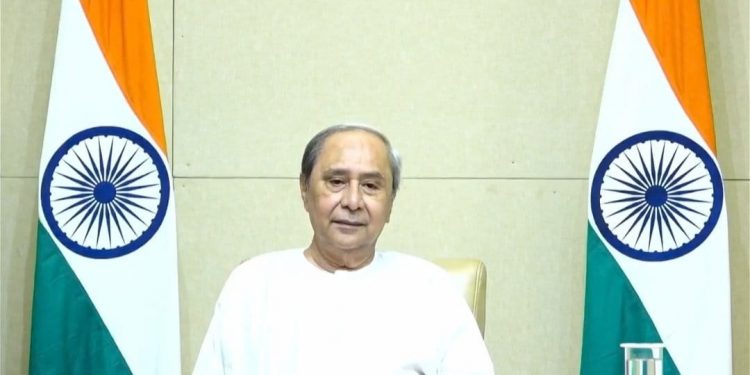

Bhubaneswar: Chief Minister Naveen Patnaik Tuesday launched ‘Ama Bank’, an ambitious initiative of the state government for providing 15 banking services through CSP (customer service point) Plus outlets in 4,373 unbanked gram panchayats (GPs) of Odisha. Odisha is the first state in the country to conceptualise and implement such a holistic scheme for financial inclusion.

In the first phase, 750 CSP Plus outlets covering 30 districts were dedicated to the people of Odisha. The initiative will be implemented in a phased manner to cover all 4,373 unbanked gram panchayats within the current financial year 2023-24. Launching ‘Ama Bank’, Naveen said, “Financial inclusion is the foundational premise of social and economic progress and empowerment of people. No country or state can ever attain inclusive growth without achieving financial inclusion for its people. Reaching out to the people at the bottom of the pyramid and delivery of public services to the last mile in a fair and transparent manner has been one of the highest priority agenda of the government.”

According to sources, financial inclusion has remained a challenge as the geographical penetration of banks in the state has been rather dismal. About 65 per cent of GPs do not have a brick-and-mortar bank branch, leading to severe challenges in accessing banking services and availability of Direct Benefit Transfer (DBT) for a majority of people in rural Odisha.

To address the issue, the state government in collaboration with six public sector banks (PSBs) – SBI, PNB, UBI, UCO Bank, Bank of India, and Bank of Baroda – has come up with an ambitious and people-centric scheme ‘Ama Bank’ for providing banking services through CSP Plus outlets to every unbanked gram panchayat. ‘Ama Bank’ is a low-cost brick-and-mortar micro bank branch that sits between a BC and a small bank branch and will provide 15 necessary banking services like deposits, advances, remittances, loans, an Aadhaar-enabled payment system, credit linkage to self-help groups and coverage under social security schemes.

Odisha government will provide rent-free banking space for five years. The state government will also bear one-time expenses for fixed costs and recurring expenses for a period of three years. A provision of Rs 500 crore has been made for the purpose.

ARINDAM GANGULY, OP