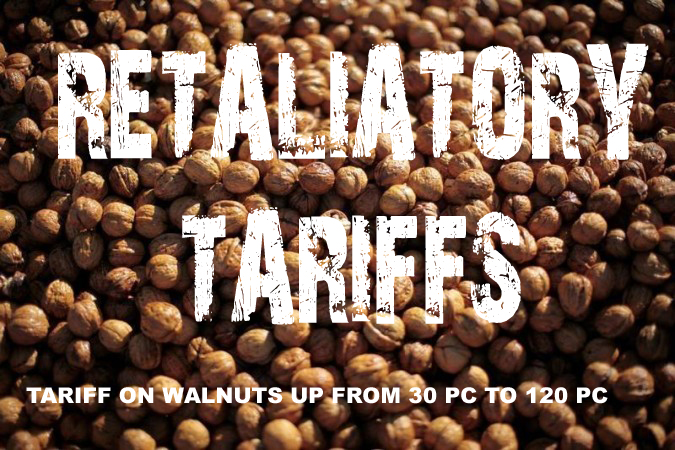

Retaliatory tariffs that India is imposing on 28 American products have kicked in June 16, 2019, Sunday. It is a move that India has made after much consideration and eight postponements, but may not achieve anything significant. The US had raised tariffs on aluminium and steel imports from India from 10 per cent to 25 per cent in March last. The export of aluminium and steel from India to the US stood at $1.5 billion annually. India, too, decided to retaliate June 21 last, as the US decision had implications to the tune of $240 million on Indian exports. The retaliatory tariffs have been imposed on goods, including walnut (tariff hiked from 30 per cent to 120 per cent); chickpea, Bengal gram and masur dal (from 30 per cent to 70 per cent); and lentils (from 30 per cent to 40 per cent). India has also retained the existing MFN rate on all countries, except the US. The increase in tariffs is expected to yield another $217 million in revenue from imports. India has already dragged the US to the dispute settlement mechanism of the World Trade Organisation over import duties on steel and aluminium. India’s actions have come at a time when the US is steeped in a trade war with China. US is also embroiled in a tussle with Iran over the nuclear programme of the Islamic republic. This step has direct implications for India, too, which has already agreed to stop import of crude from Iran. Iran has been one of the top suppliers of oil to India.

It is bearing the brunt of costlier oil imports now. Also, the withdrawal of export incentives under Generalised System of Preferences programme of the US, June 5, is expected to affect export of goods worth $5.5 billion from India. which has had a favourable trade balance with the US. In 2017-18 the exports to the US from India stood at $47.9 billion compared with imports to the tune of $26.7 billion. Given the situation, India is more dependent on the US as a market for its products. Unless India finds an alternative market for its goods, it will be at the receiving end. The Chinese have found effective ways of managing such a crisis by working diligently towards creating markets not only in the neighbourhood but also in Africa, South America and Western Europe. Their products reach all countries on the globe. It has pried open markets in small nations such as Pakistan, Sri Lanka and Nepal. China has used its equipment and manpower to create infrastructure in these developing nations. But the rate at which it has lent capital to such countries is exorbitant and, therefore, next to impossible for these countries to repay. China has also been found to be dumping its goods in these countries. The blistering pace of manufacturing that China has set is unsustainable unless it has a vast market to sell its products. India already has a trade deficit with China. It is only bound to widen unless this country uses the opportunity wisely to gain a foothold in China. India will have to barter support in return for opening of trade in favour of its products. Regional cooperation is vital and India has to try and match up. It can only happen at the cost of Chinese hegemony. To come to terms with a tough situation of this nature, India better start preparing for the future. Unless India strikes the right balance, it will be difficult for the nation to ride the rough seas of trade that is going to be further stirred by not only increasing protectionism but pressures such as the kind being practiced by the US currently.