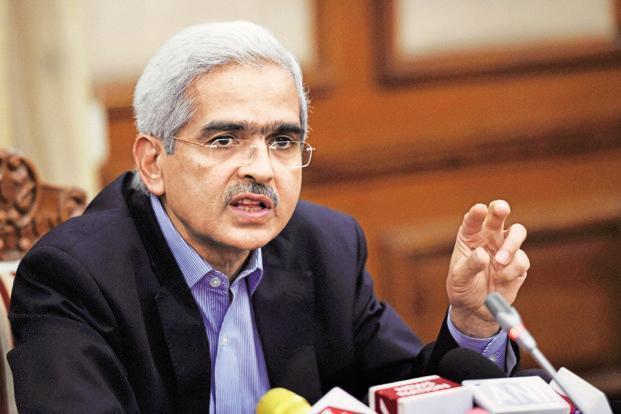

New Delhi: Reserve Bank of India (RBI) Governor Shaktikanta Das advised banks Monday to proactively raise capital and not wait for a difficult situation to arise amid the COVID-19 pandemic. Banks are staring at a risk of soaring bad loans due to the coronavirus crisis and would therefore require capital to survive.

“In fact, I have already advised banks and the NBFCs to undertake COVID-19 stress tests and raise capital ahead of the curve rather than waiting for a situation to arise, and these are the issues which we are constantly working on in RBI,” Das said at a CII event here Monday.

As per the latest Financial Stability Report (FSR) released by the RBI, gross non-performing assets of all banks may jump to 12.5 per cent by the end of this fiscal under the baseline scenario, from 8.5 per cent in March 2020.

“If the macroeconomic environment worsens further, the ratio may escalate to 14.7 per cent under the very severely stressed scenario,” the report released last week said.

The resilience of Indian banking in the face of macroeconomic shocks was tested through macro stress tests which attempt to assess the impact of cumulative shocks on banks’ balance sheet and generate projections of gross non-performing asset (GNPA) ratios and capital to risk-weighted assets ratio (CRARs) over a one-year horizon under a baseline and three adverse – medium, severe and very severe – scenarios, the report further stated.

Earlier this month, Das had said building buffers and raising capital will be crucial not only to ensure credit flow but also to build resilience in the financial system.

“In such a situation, it has become a lot more important that the banks have to improve their governance, sharpen their risk management skills and banks have to raise capital on an anticipatory basis instead of waiting for a situation to arise. Proactively, it is necessary for both public and private sector banks to build up adequate capital buffers,” Das had stated.