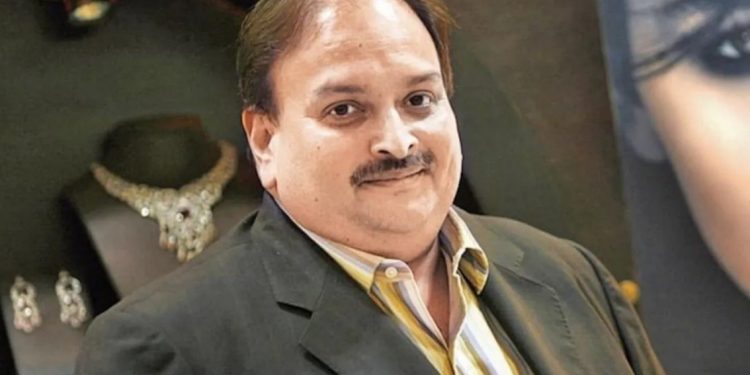

New Delhi: The CBI has a filed a fresh FIR against fugitive diamantaire Mehul Choksi for allegedly cheating a Canara Bank-led consortium to the tune of Rs 55.27 crore, officials said Thursday.

The agency acted nearly a year after the bank gave its complaint on August 30, 2021 against Bezel Jewellery, earlier known as D’damas jewellery, a part of Gitanjali Gems, and its whole-time directors, including Choksi, Chetna Jhaveri, Dinesh Bhatia and Milind Limaye.

The Maharashtra government allowed the Central Bureau of Investigation (CBI) to probe the case, granting sanction under the Delhi Special Police Establishment Act, which governs the agency, on February 22 this year.

The CBI conducted searches at the premises of Jhaveri, Bhatia and Limaye in Mumbai after registering the FIR on Tuesday.

The Canara Bank and the Bank of Maharashtra had sanctioned Rs 30 crore and Rs 25 crore respectively as working capital facility to Bezel Jewellery under a consortium agreement.

When the Punjab National Bank (PNB) flagged a Rs 13,000-crore fraud by Choksi and his nephew Nirav Modi in January 2018, the other lending banks, at a meeting on February 21, 2018, decided to call the accounts of the group companies and the non-performing assets (NPAs).

They subsequently ordered a forensic audit that showed gross irregularities in the company’s accounts, the FIR alleged.

The outstanding amount, which was Rs 55.27 crore as on the date of the NPA in 2017-18, had swollen to Rs 78.14 crore on August 12, 2021, days before the banks filed the CBI complaint, it said.

The prime security held by the bank includes stocks of jewellers at various godowns and book debts that were seized by the Enforcement Directorate (ED) in the PNB fraud case.

“Branch has written to the Enforcement Directorate about our charge on the stocks which belong to Bezel Jewellery. However, they are yet to hear from them,” it said.

It is alleged that though the loan was granted for the manufacturing and sale of gold and diamond-studded jewellery, the company did not route any of the business transactions through the account to hide diversion of funds.

“…It is observed that the company has not routed any of the business transactions through the account since the beginning and transactions which appear in the account are with their group concerns only, which indicate diversion of funds,” the Canara Bank said in its complaint, which is now part of the FIR.

Within the first year of availing the credit facilities, the company repaid its long-term borrowing of Rs 18 crore to its parent company Gitanjali Gems, diverting its working capital limits.

The company did not furnish correct information regarding the stocks, sales and realisations in the stock statements submitted to the banks, it said.

“…The account was always overdrawn due to interest debit and was continuously appearing in the Special Mention category,” it said.

Choksi and Modi had allegedly pulled off the biggest banking scam of that time by availing loans from foreign banks using letters of undertaking, a kind of bank guarantee, from the PNB.

These loans were not repaid, bringing a liability of around Rs 13,000 crore on the PNB.

Both fled the country days before the PNB approached the CBI with its complaint.

Choksi had planned his meticulous exit by getting citizenship in Antigua and Barbuda in 2017.

After fleeing India, he comfortably settled in the Caribbean island country. His stay was shaken last year when he was found in neighbouring Dominica under suspicious circumstances.

India dispatched all possible legal arsenal to bring him back but Choksi was able to get bail from the local courts, which allowed him to travel back to his sanctuary in Antigua and Barbuda.

The case of illegal entry into Dominica has also been dropped by a court there.

PTI