New Delhi: The government is considering a plan to transfer cash to farmers to ease their financial burden instead of offering subsidies, people with knowledge of the matter said. The government is planning to combine all farm subsidies, including fertilizer costs, and instead pay farmers cash, the people said, asking not to be identified as the discussions aren’t public.

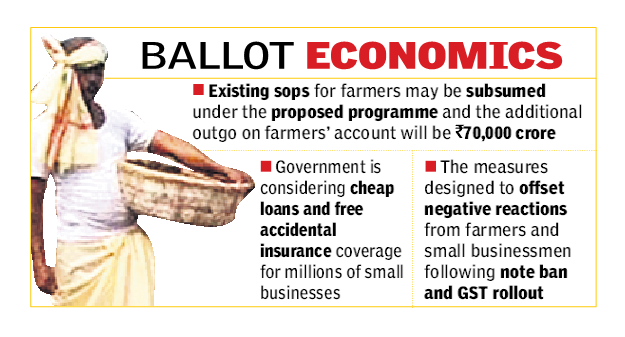

The additional cost will be limited to Rs 70,000 crore ($9.8 billion) annually after a full roll-out of the program, the people said. Finance minister Arun Jaitley had budgeted Rs 70,100 crore for farm subsidies in the year ending March 31. Finance ministry spokesman DS Malik didn’t respond to two calls made to his mobile phone.

The plan for the handout comes after the ruling Bharatiya Janata Party was voted out in key state elections last month, forcing PM Modi to draw up a course correction before the national polls due by May. The government, which has already exceeded the annual budget deficit target, has little room for spending in the current year, having forgone some tax revenue on goods and services following the defeat.

The additional spending won’t impact the nation’s fiscal deficit for the current year ending March 31, the people said. The rupee and bonds rebounded after the report pegged the cost lower than the over Rs 2 lakh crore estimated initially.

While the government had forecast a budget deficit of 3.3 per cent of gross domestic product for the current fiscal year, economists expect India to miss the goal for a second year in a row as the administration gives into populist pressures.

Modi, who is seeking a second term, has to win over discontented farmers before the election. They have been hit by falling crop prices and rising input costs, prompting thousands of them to protest in the street to seek debt waivers.

The Centre is also considering offering cheap loans and free accidental insurance coverage to millions of small businesses, two government sources with direct knowledge of the matter said, as he tries to placate a key voter bloc ahead of a general election due by May.

Small business groups have been critical of the Modi government in the past year after many firms were squeezed by a shock move to ban high-value currency notes in 2016, followed by a hasty implementation of a nation-wide goods and services tax (GST) that raised their compliance costs.

In a bid to win them back, and following election losses in five states last month, the government run by Modi’s Bharatiya Janata Party (BJP) recently announced GST concessions and tweaked an ecommerce policy in favour of small traders.

More measures are now being planned, said the sources, who declined to be named as the information was not public. A spokesman for the Ministry of Finance did not immediately respond to an email seeking comment. The sources did not quantify the amount the series of measures would cost the government, as details are still being worked out.

The government is working on offering a discount of 2 percentage points on loans for businesses with annual sales of less than 50 million rupees ($701,754), the sources said, and would compensate banks for costs. Small businesses with a top credit rating can get loans from banks at about 9-10 percent, while lower-rated businesses can be charged around 13-14 percent.

But only about 4 percent of the 70 million small enterprises in India have access to bank credit, said Praveen Khandelwal, secretary general of the Confederation of All India Traders. He said 30 percent of their loans come from the country’s shadow banking sector, while more than half are provided by private money lenders at rates as high as 25 percent a month.

One of the sources said the government may also ask banks to open a special window for increasing the credit flow to small businesses, which will ensure greater availability of loans. The government is also planning to provide free accidental insurance coverage of up to 1 million rupees to small businesses with annual sales of up to 100 million rupees, the sources said.

“Employees of small traders may also get discounts on opting for state-backed insurance schemes,” one of the sources said. The government has not yet decided if the moves would be announced before the interim budget on Feb. 1, the sources said.

The government is also considering a pension programme for retired traders registered with the government, and a further discount on interest rates paid on loans to women traders.