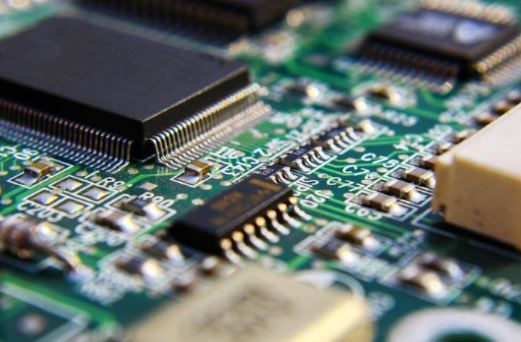

New Delhi: As India and the US double down on domestic semiconductor manufacturing, China witnessed its biggest-ever monthly decline in chip manufacturing in August owing to Covid restrictions and weakening demand.

According to the South China Morning Post, the production of integrated circuits (ICs) slumped 24.7 per cent year on year to 24.7 billion units, marking the largest single-month decrease since 1997.

This is also the second consecutive month of decline for chip manufacturing. In July, the output nosedived 16.6 per cent to 27.2 billion units.

Local output of microcomputers fell 18.6 per cent to 317.5 billion units in August.

In August, domestic manufacturing activity contracted for the first time in three months, the report mentioned.

A record 3,470 chip-making companies “went out of business in the first eight months of the year”, according to statistics from business database platform Qichacha.

The slump in chip production in China is coming as both India and the US ramp up efforts to bolster local chip manufacturing.

The Gujarat government has partnered Vedanta and Foxconn, aiming an investment of Rs 1.54 lakh crore to achieve self-reliance in the field of semiconductor manufacturing.

India’s semiconductor component market is likely to reach $300 billion in cumulative revenues by 2026, as ‘Make in India’ and production-linked incentive (PLI) schemes will boost local sourcing of semi-components in the coming years, according to the report by the India Electronics & Semiconductor Association (IESA) and Counterpoint Research.

The Indian government has announced an outlay of Rs 76,000 crore (around $10 billion), under its PLI scheme, separately for the development of a semiconductor and display manufacturing electronics ecosystem.

Meanwhile, US President Joe Biden has signed into law the Chips and Science Act, which provides nearly $52 billion in semiconductor production incentives.

Intel has kicked off work on the new $20 billion semiconductor plant in the Ohio state in the US.

Samsung has floated an idea of investing nearly $200 billion to build 11 more chip plants in the US over the next two decades.

IANS