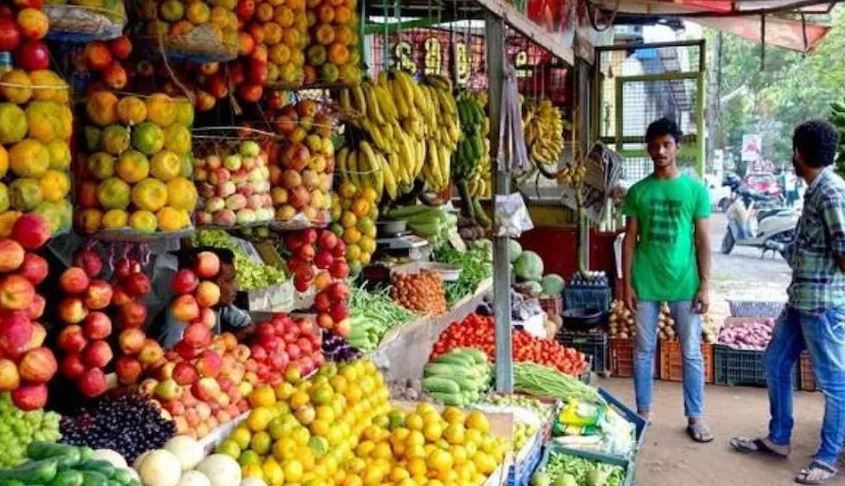

Chennai: Punching new holes, households are expected to tighten their belts as the inflation or prices of essentials and non-essentials are expected to rise in the coming months, said experts and the general public.

Broadly a combination of global and local (glocal) factors — geopolitical developments, crop production, reduction in crude oil production and the resulting price increase and depreciating rupee — are expected to heat up the prices.

The heating up of the prices is already happening and will continue to happen.

A top official of a city-based star hotel told IANS that their raw food costs have gone up and is continuing to hike, which have prompted hotels to revised prices of the dishes.

A recent survey of households by the Reserve Bank of India (RBI) showed that most categories of respondents expect higher inflation for both three months and one year ahead.

A larger share of households expects higher prices for all product groups.

Overall prices and inflation expectations for the three months ahead period were generally aligned with food products, non-food products and cost of services, while they were more aligned with non-food products and cost of services for the longer horizon of one year, the survey revealed.

In India, the retail inflation rose to 7 per cent in August from 6.71 per cent in July.

The RBI on its part is trying to reign in inflation by increasing the repo rate — the rate at which it lends to the banks.

The central bank has increased the repo rate by 190 basis points in recent times and the last one was by 50 basis points last month.

Announcing the credit policy RBI Governor Shaktikanta Das said: “There are also upside risks to food prices. Cereal price pressure is spreading from wheat to rice due to the likely lower kharif paddy production.

“The lower sowing for kharif pulses could also cause some pressures. The delayed withdrawal of monsoon and intense rain spells in various regions have already started to impact vegetable prices, especially tomatoes. These risks to food inflation could have an adverse impact on inflation expectations.”

According to the RBI Governor, the Indian basket crude oil price was around $104 per barrel in H1:2022-23 and expected to be around $100 per barrel in H2: 2022-23.

“Taking into account these factors, the inflation projection is retained at 6.7 per cent in 2022-23, with Q2 at 7.1 per cent; Q3 at 6.5 per cent; and Q4 at 5.8 per cent, with risks evenly balanced. CPI (consumer price index) inflation is projected to further reduce to 5.0 per cent in Q1:2023-24,” Das said.

However, one has to see the RBI’s prediction as to crude oil prices ($100 per barrel) as the oil producing countries have announced a cut in their production and the international prices going up.

Economists and common man have a different take on RBI’s expectations on inflation.

“Presently inflation does appear unlikely that inflation will move downwards for two sets of factors. The increase in oil price and rupee deprecation has potential to increase imported inflation,” Madan Sabnavis, Chief Economist, Bank of Baroda, told IANS.

“Second, there have been some shortfalls in kharif production which will mean an increase in prices. Also late withdrawal of rain has affected vegetable crops and also adversely affected the harvest of rice and oilseeds in some regions,” Sabnavis added.

The reduction in sown area for rice and pulses during Kharif season is expected to feed inflation in the coming months.

The overall sown acreage for the Kharif season has declined by 0.8 per cent at the end of September 30, 2022 as compared to last year, the Bank of Baroda said in a recent report.

The sowing area of rice and pulses was down by 4.8 per cent and 4 per cent, respectively.

Among pulses, arhar (4.4 per cent), moong (4 per cent) and urad (3.8 per cent) have registered lower sowing.

Area sown for oilseeds (1 per cent) and jute and mesta (0.1 per cent) remain lower compared with last year’s levels.

“Any shortfall in oilseeds production will impact production of edible oils and our imports will increase. Presently 60 per cent of our requirements are through imports. With prices firming up there will be automatic transmission that will have an impact on inflation,” Sabnavis said.

While the sown acreage of rice, pulses and oilseeds are down, the food inflation will moderate only the production goes up.

“The inflation rate will be 6.5-7 per cent in FY23 and 5.5-6 per cent in FY24,” Sabnavis predicts.

With prices of food items going up in the domestic market, the government has taken up measures like reduction in import tariff, limiting the stock of edible oil to prevent hoarding.

The government has prohibited exports of food products like wheat flour/atta, rice, maida etc. to keep domestic supplies steady and curb rise in prices.

The impact of these measures is expected to be felt more significantly in the coming weeks and months, the Central government said.

The rupee depreciation against the US dollar also fuels inflation as imports (crude and edible oils) turns costlier.

According to S&P Global Ratings, the skyrocketing of the US dollar against various currencies in 2022 is posing problems for advanced and emerging markets. The resolution of the issue is not just dependent on economics but also on politics.

The global commodity prices have moderated halting rise in prices of consumer goods.

IANS