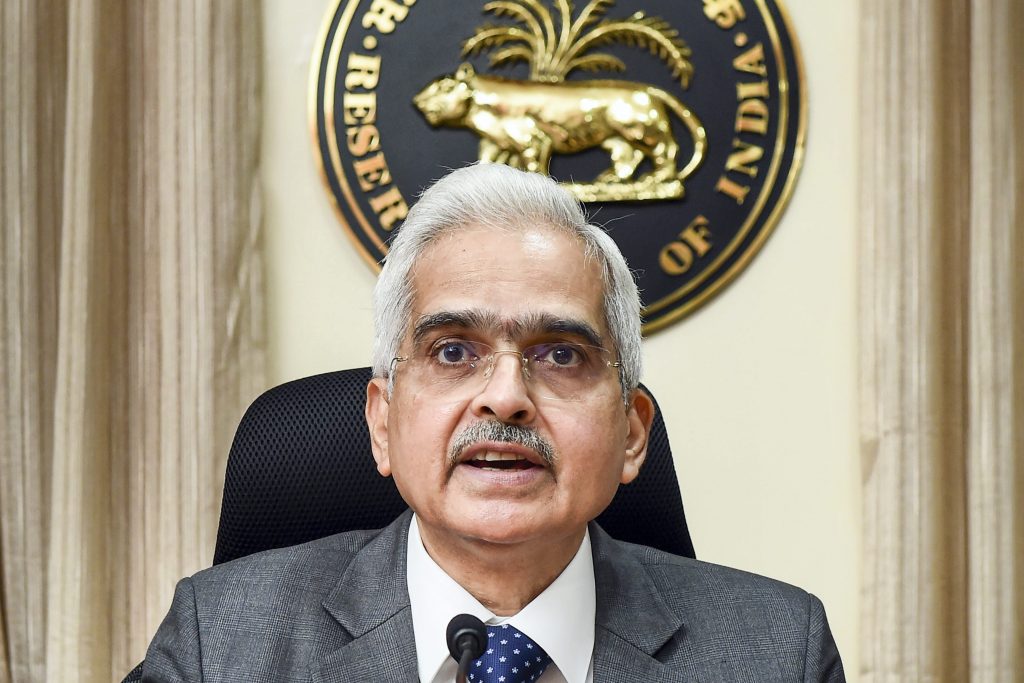

Mumbai: Reserve Bank of India (RBI) Governor Shaktikanta Das described cryptocurrencies as ‘clear danger’ Thursday. He said that anything that derives value based on make believe, without any underlying, is just speculation under a sophisticated name. Shaktikanta Das also informed that the government is in the process of finalising a consultation paper on cryptocurrencies after gathering inputs from various stakeholders and institutions.

RBI has been flagging concerns about cryptocurrencies, which are seen as a highly speculative asset.

In the foreword to the 25th issue of the Financial Stability Report (FSR) released Thursday, Das also said that as the financial system gets increasingly digitalised, cyber risks are growing and need special attention.

“We must be mindful of the emerging risks on the horizon. Cryptocurrencies are a clear danger. Anything that derives value based on make believe, without any underlying, is just speculation under a sophisticated name,” Das stated.

Also read: GST Council mulling 28% tax on Bitcoin, other cryptocurrencies

In recent weeks, cryptocurrencies, which are not back by any underlying value, have witnessed massive volatility amid global uncertainties.

RBI first came out with a circular regarding cryptocurrencies in 2018. It had barred entities regulated by it from dealing in such instruments. However, in early 2020, Supreme Court struck down the circular.

While regulatory clarity is yet to emerge with respect to the cryptocurrency space in the country, the government is working to finalise a consultation paper on cryptocurrencies with inputs from various stakeholders and institutions, including the World Bank and the IMF.

In the foreword of the FSR, Das also said that while technology has supported the reach of the financial sector and its benefits must be fully harnessed, its potential to disrupt financial stability has to be guarded against. “As the financial system gets increasingly digitalised, cyber risks are growing and need special attention,” Das noted.

Regarding the economy, Das said it is skewed towards global spillovers and geopolitical tensions. The Indian financial system exhibits underlying robustness and resilience to withstand these shocks. “Our endeavour is to face all challenges, external and internal, with strength and innovative solutions for the Indian financial system,” Das added.