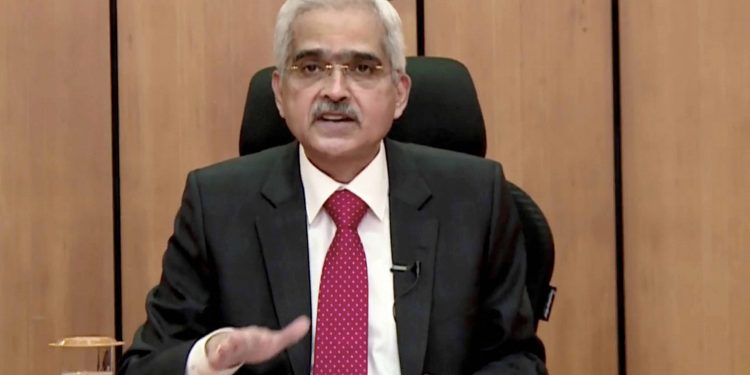

Mumbai: After the 23.9 per cent GDP contraction in the April-June quarter following the COVID-19 pandemic, economic recovery momentum has been stronger than expected, Reserve Bank of India (RBI) Governor Shaktikanta Das said Thursday. He however, cautioned that we need to be watchful of the demand momentum sustaining after the festivities as well. Shaktikanta , and also warned of downside risks to growth coming from a rise in virus infections in select pockets.

The heavy contraction in Q1 was attributed to the near-complete chilling of all economic activity in the wake of one of the strongest lockdowns enforced anywhere in the world.

The RBI has introduced many unconventional measures to aid recovery apart from cutting key rates by 1.15 per cent, expects the economy to shrink by 9.5 per cent in FY21.

“After witnessing a sharp contraction in the economy by 23.9 per cent in Q1 and a multi-speed normalisation of activity in Q2, the Indian economy has exhibited stronger than expected pick-up in momentum of recovery,” Das said, speaking at the annual day event of Foreign Exchange Dealers’ Association of India (FEDAI).

Also read: RBI Governor Shaktikanta Das tests positive for COVID-19

“We need to be watchful about the sustainability of demand after festivals and a possible reassessment of market expectations surrounding the vaccine,” Das added.

Analysts at Icra, a rating agency, had earlier this week raised doubts over the sustainability of demand and attributed the spurt to pent-up requirements following the lockdowns and also the festivities.

In what can assuage some concerns following the inflation over-shooting the upper end of the RBI’s target band for many months, Das reiterated the rate-setting panel’s resolve to ‘see through temporary pressures’ on price rise.

“The monetary policy guidance in October emphasised the need to see through temporary inflation pressures and also maintain the accommodative stance at least during the current financial year and into the next financial year,” Das pointed out.

Das said a comfortable external balance position, wherein India’s forex reserves have risen to USD 572.7 billion as of November 13 or sufficient to cover a year’s imports, have been a key source of resilience in recent months. He added that the government’s production-linked incentives scheme to up India’s share in global supply chains can also leverage on it.

Terming 2020 as year like never before, the RBI Governor warned of rising virus infections in parts of India as a downside risk to growth and added that certain advance economies in Europe who are also witnessing a surge in cases can hurt global growth as well.

Das said regulatory reforms have moved the financial markets to the next trajectory amid the pandemic and affirmed RBI’s commitment to ensure an orderly conduct in the markets and mitigate any downside risks.

The central bank acted both proactively and reactively to the crisis with both conventional and unconventional measures, he said, applauding the market for responding to those with alacrity.

“The Reserve Bank remains committed to fostering orderly functioning of financial markets and will continue to evaluate incoming information having a bearing on the financial markets and act, as needed, to mitigate any downside risks,” Das informed.