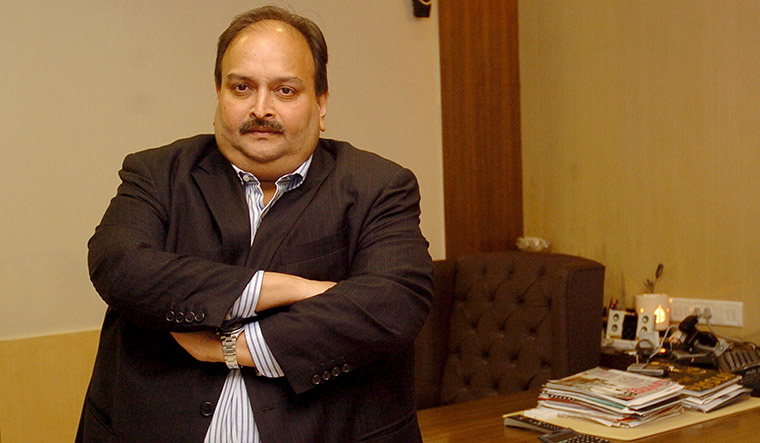

New Delhi: The Enforcement Directorate (ED) has attached assets worth over Rs 14 crore belonging to the Gitanjali Group and its promoter and jeweller Mehul Choksi. He is one of the prime accused in the alleged over Rs 13,000 crore PNB loan fraud case. Mehul Choksi is currently living in the West Indies.

The properties attached, under the anti-money laundering law, include a flat measuring 1,460 sq feet located at O2 Tower in Goregaon area of Mumbai, gold and platinum jewellery, diamond stones, necklaces made of silver and pearls, watches and a Mercedes Benz car, the ED said in a statement.

A provisional order for attachment has been issued under the Prevention of Money Laundering Act (PMLA) for the assets worth a total Rs 14.45 crore that are in the name of Gitanjali Group of companies and its director Mehul Choksi, the ED said.

Choksi, 61, is the maternal uncle of Nirav Modi who is the other prime accused in the alleged over USD 2 billion (more than Rs 13,000 crore) Punjab National Bank (PNB) fraud case. Choksi has fled India and is stated by probe agencies to be based in Antigua and Barbuda.

Nirav Modi, 49, is in a London jail after he was held by authorities there in 2019 on the basis of a legal request made by the ED and the Central Bureau of Investigation (CBI) in this case. He is contesting extradition to India.

The two, their family members and employees, bank officials and others were booked by the ED and the CBI in 2018 for perpetrating the alleged fraud in the Brady House branch of the PNB in Mumbai.

It was alleged that Choksi, his firm Gitanjali Gems and others ‘committed the offence of cheating against the Punjab National Bank in connivance with certain bank officials by fraudulently getting the LOUs (letters of undertaking) issued and got the FLCs (foreign letter of credit) enhanced without following prescribed procedure and caused a wrongful loss to the bank’.

The ED said its probe found that ‘PNB bank officials in connivance with Choksi, Gitanjali Gems and others originally issued FLCs for smaller amount within the sanctioned limit and once FLC number was generated, the same number was used for amendment by way of enhancement of FLC and increase in the amount and such enhancement of amount was done at 4-5 times higher value of the original FLC amount’.

“Such amendments were done outside the CBS system and hence it was not captured in the books of bank,” the ED alleged.