Santosh Kumar Mohapatra

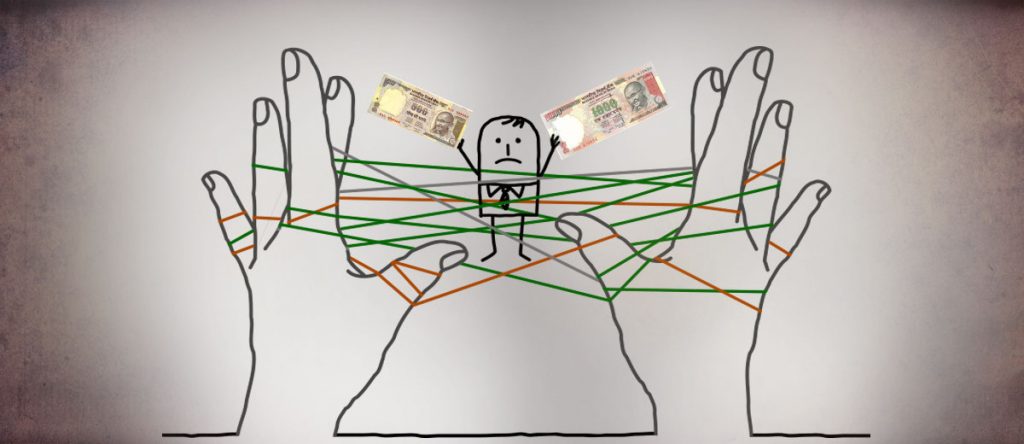

On the second anniversary of demonetisation, opposition parties lambasted the ban and termed the step as “ill-advised” and “Tughlaqi”; the government, in turn, defended the decision. Finance Minister Arun Jaitley said the real purpose of demonetisation was not the confiscation of cash but to bring money into the formal economy and make holders pay tax. He probably believes Indians are fools with bad memory. On November 8, 2016, Prime Minister Narendra Modi, while announcing demonetization, had said that the objective of demonetisation was to curb black money, fake currency and terror financing.

The PM used the word ‘black money’ 18 times in his hour-long speech. There was no mention of digitisation, cashless economy, rise of income tax, formalisation of economy or enhancing financial inclusion. And, achieving none of these objectives warrants as gruesome a step as demonetisation.

Over a 100 lives were lost. Fifteen crore daily wage earners lost livelihoods for weeks. Thousands of SME units were shut down. The informal sector was decimated and lakhs of jobs were destroyed by demonetisation. The economy lost 1.5 per cent of GDP in terms of growth, which is equivalent to a loss of Rs 2.25 lakh crore a year. The bitter truth is that while failing miserably to achieve the stated objectives of demonetisation, the government is shifting goal posts to camouflage their failure.

Steve Forbes, the Editor-in-Chief of Forbes Magazine, had in an article called demonetisation a ‘massive theft of people’s property’. Former RBI governor Raghuram Rajan said for four years — 2012 to 2016 — India was growing at a faster pace before it was hit by demonetisation and GST. Growth fell in 2017 when the global economic growth was peaking.

Jaitley said demonetisation compelled holders of cash to deposit it with banks. A total of 17.42 lakh accounts were considered suspect but how many of these account holders were unable to explain the source of their deposits? And what was the quantum of black money detected?

The government brags that an increase in tax collection was a key success of demonetisation. In reality, growth in tax collections is yet to reach pre-demonetisation and pre-financial crisis levels

The government brags that an increase in tax collection was a key success of demonetisation. In reality, growth in tax collections is yet to reach pre-demonetisation and pre-financial crisis levels. Tax buoyancy has been fluctuating over the past 10 years. From two years prior to demonetisation, direct tax collections (which includes corporate, personal and other taxes) had increased 6.70 per cent in 2015-16 and 8.96 per cent in 2016-17. In the next two years, post-demonetisation, the increase was by 14.6 per cent in 2016-17 and 18 per cent in 2017-18. But this pales compared with total direct tax collections pre-crisis and post-crisis, when it grew 24 per cent 39 per cent and 35.56 per cent in 2005-06, 2006-07 and 2007-08 respectively.

Similarly, personal tax collections rose during 2017-18 by 20.2 per cent over 2016-17, but this is just half the growth rate of 41 per cent seen in 2007-08. In the case of corporate taxes, the same trend is visible. Corporate tax grew by 18 per cent in 2017-18, which is far less than the 42.5 per cent rise experienced in 2006-07. Corporate taxes as a share of GDP have declined in this period. Corporate taxes that made up 3.89 per cent of the GDP in 2010-11 dipped to 3.41 per cent of GDP in 2017-18.

The contribution of direct taxes to total tax collections is 52.29 per cent in 2017-18, which is far from 56 per cent registered prior to note ban years. Direct tax collection as a proportion of total tax collection is 60.78 per cent in 2009-10 and 56.48 per cent in 2010-11, 55.82 per cent in 2011-12, 54.17 per cent in 2012-13, 56.32 per cent in 2013-14, 56.16 per cent in 2014-15 which are higher than what is achieved after demonetisation.

Government claims that demonetisation led to an expansion of tax base and income tax filers. Actually, the rise is normal. India had 3.8 crore income tax filers in May 2014, which has increased to 4.07 crore in 2016-17 and then to 6.84 crore at the end of 2017-18. However, to assume the same has led to a proportional surge in tax collections might be misleading. It may be possible that people who paid taxes earlier did not file income-tax returns and started filing after GST.

A rise in taxes can be truly reflected by tax-GDP ratio. This ratio was 10.64 per cent in 2015-16; it increased to 11.17 per cent in 2016-17 and is estimated to be 11.77 per cent in 2017-18. This may lead to a conclusion that demonetisation had a positive impact on tax collection. But this marginal rise is mainly due to rise in excise taxes on petroleum products and rise in disinvestment proceeds. However, it is less than tax-GDP ratio of 12.94 per cent achieved in 2006-07. Had there been any substantial rise in taxes after demonetisation, the government could not have forced RBI to pay more dividend or part of its reserves.

Jaitley also said demonetisation has ushered in better quality of life for Indian citizens and added that the system required to be shaken to help India move to a digital economy. Demonetisation has actually proven to be a disaster and has not curbed black money. Cash has again become king. The majority of participants in a survey conducted by Local Circles covering 15,000 people in 215 districts, believe black money was back to scale after demonetization and that with the 2019 elections coming up, its circulation will only increase. Without attacking the origin of black money such as the electoral process, criminalisation of politics, cronyism, tax havens and participatory notes, no such measure will be fruitful.

The writer is an Odisha-based economist. e-Mail: skmohapatra67@gmail.com.