Armed with WhatsApp, Instagram and Messenger, social media giant Facebook has launched the ‘Facebook Pay’ digital payment system in the US to rival Apple Pay and Google Pay. Global rollout should follow.

While its large user base across the globe is expected to make a huge dent in the business of its rivals, it is expected to give a big push to digital payment system in developing countries. The privacy and security concerns that nag Facebook might act as a barrier for the company to gain customers though.

Here is all you need to know about the service.

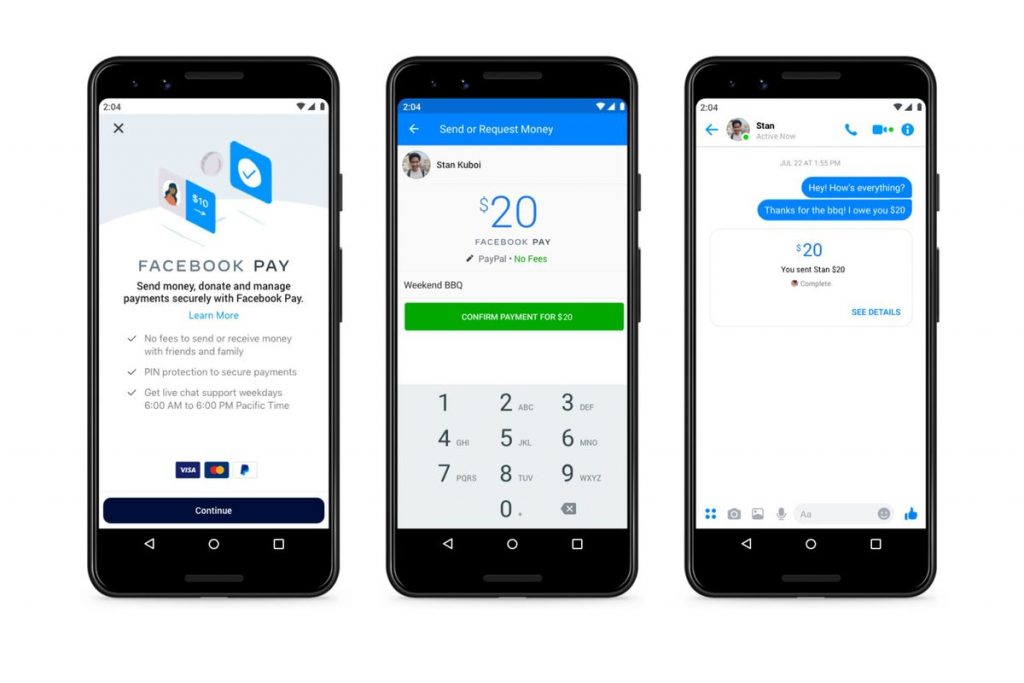

Facebook Pay was launched Tuesday and the service will be rolled out in the US starting this week. This digital payment system will let users sync their card information and purchase details across all Facebook-owned platforms such as Facebook, Messenger, WhatsApp and Instagram. This service will let you pay other people and businesses across all its platforms as well.

Facebook Pay will allow users to add a payment method on only one of its platforms. The card details will then be synced across all its platforms, and users wouldn’t be required to re-enter their payment information for each purchase. The company claimed that Facebook Pay will offer users ‘a convenient, secure and consistent payment experience’ across Facebook, Messenger, Instagram, and WhatsApp.

The social media major’s digital payment initiative will support all major credit/debit cards and PayPal. The payments will be processed in partnership with companies such as PayPal, Stripe and others around the globe, the company said.

Facebook clarified that Facebook Pay is ‘separate from the Calibra wallet which will run on the Libra network.’

“People already use payments across our apps to shop, donate to causes and send money to each other. Facebook Pay will make these transactions easier while continuing to ensure your payment information is secure and protected,” Deborah Liu, VP of Marketplace & Commerce at Facebook said in an official blog post.

Facebook claims that it will securely store and encrypt the card information and bank account details of the consumers in its servers. Besides, the company also promises to perform anti-fraud monitoring to detect unauthorised activity and alert users with notifications about recent account activity.

It may be mentioned here that Facebook has been testing WhatsApp Pay in India for more than 18 months. The company has already confirmed its plans to roll out the full version of its digital payment service in India by the end of 2019. That said, earlier this month, the Reserve Bank of India told the Supreme Court that the company is not yet compliant with the data localisation norms. This might cause delays to the company’s service launch plans here.