New Delhi: The shortage of semiconductors globally is expected to persist through 2021 and recover to normal levels by the second quarter of 2022, which will constrain the production of many electronic equipment types this year, according to research firm Gartner.

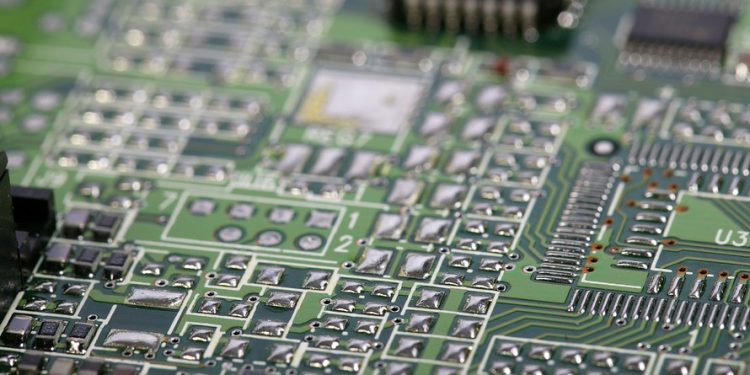

Semiconductors play a crucial role in everything, right from computers to appliances, communication devices, transportation systems to critical infrastructure.

The breakout of the COVID-19 pandemic had temporarily disrupted semiconductor shipments. However, the massive surge in global demand for mobile devices, PCs, and other devices in response to remote working and online learning has led to a severe shortage of chips.

“The semiconductor shortage will severely disrupt the supply chain and will constrain the production of many electronic equipment types in 2021. Foundries are increasing wafer prices, and in turn, chip companies are increasing device prices,” Gartner principal research analyst Kanishka Chauhan said.

Gartner said the chip shortage started primarily with devices, such as power management, display devices, and microcontrollers, fabricated on legacy nodes at 8-inch foundry fabs, which have a limited supply.

The shortage has now extended to other devices, and there are capacity constraints and shortages for substrates, wire bonding, passives, materials, and testing, all of which are parts of the supply chain beyond chip fabs, it added.

These are highly commoditised industries with minimal flexibility/capacity to invest aggressively on short notice.

“Across most categories, device shortages are expected to be pushed out until the second quarter of 2022, while substrate capacity constraints could potentially extend to the fourth quarter of 2022,” Gartner said.

Gartner recommended that OEMs (Original Equipment Manufacturer) that are dependent directly or indirectly on semiconductors, take four key actions to mitigate risk and revenue loss during the global chip shortage.

These include the extension in supply chain visibility, guaranteeing supply with companion model and/or pre-investments, tracking leading indicators, and diversifying supplier base.

“Since the current chip shortage is a dynamic situation, it is essential to understand how it changes on a continuous basis. Tracking leading indicators, such as capital investments, inventory index, and semiconductor industry revenue growth projections as an early indicator of inventory situations, can help organisations stay updated on the issue and see how the overall industry is growing,” Gartner research vice president Gaurav Gupta said.

PTI