indo-asian news service

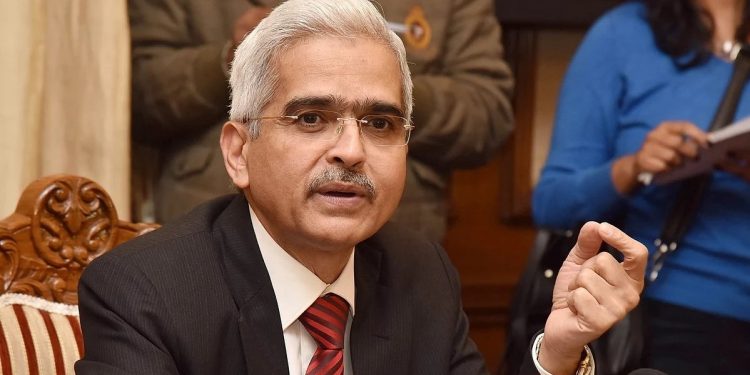

New Delhi, Feb 18: Taking note that benefits of lower interest rates were not reaching consumers, Reserve Bank of India (RBI) Governor Shaktikanta Das will meet public and private sector banks February 21 to persuade them to pass on the benefits.

“I will meet Chief Executive Officers and managing directors of private and public sector banks February 21 over this because transmission of monetary policy decisions is important. We will see what needs to be done,” he said after a customary post-budget meeting of the RBI Board with the Finance Minister.

Earlier this month, the RBI cut the benchmark interest rate by 0.25 per cent to 6.25 per cent. But PSU and private banks are yet to pass on the resultant benefits to customers.

The RBI is mandated to see whether banks are cutting lending rates in line with repo rates. For this, the RBI will start linking interest rates to external benchmarks replacing MCLR.

The home loan borrowers have often complained about the opacity of interest rate fixing mechanism, which allows banks to not pass on the rate cut benefits to customers.

As and when the external benchmark rate changes, it will reflect in the change in interest rate of the loan as well.

The RBI had earlier proposed that from April 1, 2019, banks would have to use external benchmarks instead of the present system of internal benchmarks — Prime Lending Rate (PLR), base rate based on PLR, and Marginal Cost of Lending Rate (MCLR) to ascertain the lending rates.

He said the RBI has received several comments on external benchmarks and is examining them.

On the government’s expectation to receive Rs 28,000 crore interim dividend from the RBI, Finance Minister Arun Jaitley said, “the RBI decides independently on the quantum of interim dividend to be paid to the Centre and a central bank committee is examining the issue.” He said it was the prerogative of the central bank to decide the quantum of RBI’s interim dividend to be paid to the government.

Das said a decision on the issue was yet to be taken and a committee was going into the issue. “Once the matter is decided, it will be communicated. I cannot pre-judge it,” he said.

The RBI’s audit board recently took up the matter. The RBI that follows the July-June fiscal year has transferred Rs 40,000 crore in the current fiscal as interim dividend. The Finance Ministry wants a formal commitment on Rs 28,000 crore interim dividend. If the RBI agrees to pay Rs 28,000 crore as interim dividend, the total surplus transfer to the government in the current fiscal would total Rs 68,000 crore.

Das declined to comment on the RBI scrutiny of two private lenders — Yes Bank and Kotak Bank. He said the Kotak Bank case is sub judice with the Bombay High Court and the issue of Yes Bank is between it and the regulator. It’s RBI’s endeavour to constructively engage with all the regulated enitites for compliance of rules and regulations, he added.

On loans to small businesses, he said the RBI has come out with the restructuring package for SMEs. Now it was up to banks to restructure loans of the eligible MSMEs as per the guidelines, he added.

The Governor said there is some credit growth visible and the aggregate flow of credit to the commercial sector has shown improvement. However, it was not broad based and was not flowing into various sectors the way it should, he added.