Are you looking to excel in options trading and maximise your profits? Building successful options trading strategies requires more than just knowledge and expertise—it also demands the right platform to execute your trades effectively.

Choosing the perfect options trading platform is a crucial step towards achieving your financial goals. This article will explore how to construct winning options trading strategies by harnessing the power of the right platform, ensuring your path to success in the dynamic world of options trading.

What is options trading and its strategies?

It’s very unlikely that you don’t know about option trading. However, let’s explain it a bit.

Options trading involves purchasing or selling contracts that provide the holder with the right, but not the duty, to purchase or sell an underlying asset at a strike price within a certain timeframe. It allows you to gain profit from price swings, hedge risks, and speculate on market moves.

There are different types of options trading strategies. Below are some of the most common types of option trading strategies:

- Covered call: Selling a call option on an already-owned stock.

- Protective put: Buying a put option to hedge against a potential stock price decline.

- Long straddle: Simultaneously purchasing a call and put options with similar strike prices and expiration dates.

- Iron condor: Combining a bear call spread and a bull put spread to profit from a range-bound market.

- Butterfly spread: Using a combination of call and put options to benefit from limited stock price movement.

- Collar: Combining a protective put and a covered call to limit potential losses and gains on a stock position.

- Strangle: Buying out-of-the-money call and put options to profit from significant price volatility.

Considerations for platform selection

To find the ideal option trading platform, consider many factors. Evaluating those factors helps you find a platform that aligns with your trading goals, provides a smooth user experience, and offers the necessary tools and support for successful options trading.

Several factors should be considered while choosing a trading platform:

1. Reliable and user-friendly interface

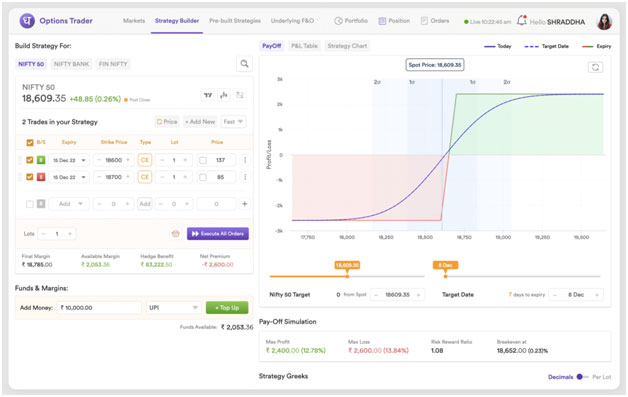

Look for a platform that is stable, easy to navigate, and provides a seamless trading experience. It should offer intuitive features and a responsive interface to execute trades efficiently.

2. Availability of tools and resources

Consider platforms with a wide range of tools and resources, such as charting tools, technical indicators, market analysis, and instructional materials.

3. Access to real-time market data

Real-time market data is crucial for timely decision-making. Make sure the platform provides up-to-date information on prices, volumes, order books and other relevant data to help monitor market trends effectively.

4. Cost and fees associated with the platform

Evaluate the platform’s fee structure, including commissions, account maintenance charges, and any additional costs. Choose a platform that aligns with your budget and trading requirements.

Dhan.co is an online trading platform that addresses these factors. It offers a reliable and user-friendly interface, making it easy for you to navigate and execute trades seamlessly.

Leveraging the right platform for success

Effectively utilising these platform features and practices, you can enhance your decision-making process, refine your strategies, and increase your chances of success in the dynamic world of trading. Leveraging the right platform for success involves:

- Utilising platform features: Make use of the platform’s tools and features to execute your trading strategies effectively, such as placing different types of orders, setting stop-loss or take-profit levels, and utilising advanced charting capabilities.

- Analysing historical data and backtesting: Take advantage of the platform’s ability to access historical market data and perform backtesting. This lets you test your trading methods in historical market situations before adopting them.

- Leveraging educational materials and support: Take use of the platform’s tutorials, webinars, articles, and video lectures. Additionally, utilise any support channels offered by the platform, such as customer service or community forums, to seek guidance and clarification on trading-related queries.

- Monitoring trades and adjusting positions: Stay actively involved in monitoring your trades through real-time updates provided by the platform. Be prepared to adjust your positions, place new orders, or close existing positions based on market movements and evolving trading opportunities.

Conclusion

When it comes to options trading, selecting the right options trading platform is crucial for success. By leveraging the features and tools offered by the platform, such as an option builder, you can design and implement effective strategies tailored to your financial goals and risk tolerance.

With careful analysis, regular monitoring, and adjustments, you can confidently navigate the dynamic options market and increase your chances of achieving profitable outcomes. Choose wisely and build your path to success in options trading.