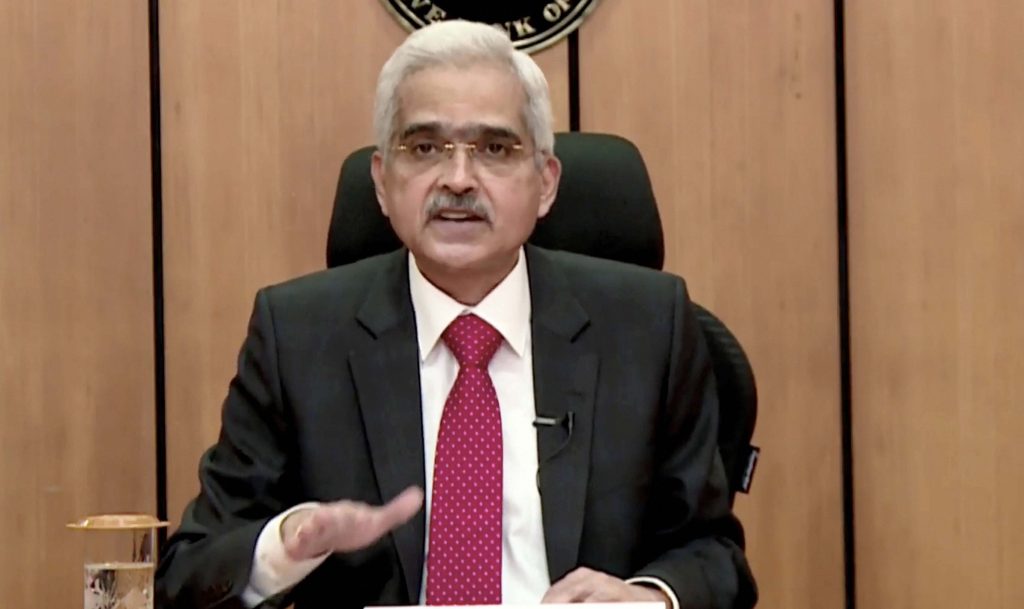

Mumbai: Reserve Bank Governor (RBI) Shaktikanta Das said Monday that with the country’s foreign exchange reserves at USD 677 billion, it is comfortably placed to deal with any spillover effects and for financing of the current account deficit. Over the last three years, India’s foreign exchange reserves have surged by USD 270 billion. Shaktikanta Das said as per the latest data, the foreign exchange reserves are USD 622 billion. Other than that, a lot of forex, amounting to USD 55 billion, are being held in our forward assets, which will mature from time to time every month.

“Our reserves are USD 677 billion (as of today). India is comfortably placed to deal with any effect of spillover or any challenge with regard to financing current account deficit,” Das said while addressing at the CII National Council meeting. Reserves render a lot of stability and confidence in any economy, Das said.

“Today, I am able to say with great confidence that we will be able to deal with any spillover effectively because of our USD 677 billion (forex reserves). So, that represents the strength of the economy and the stability of the economy and the exchange rate,” the RBI Governor pointed out.

To a suggestion of using a small portion of the reserves to finance requirements of the economy, the governor said it was not advisable. “Touching the reserves for financing various requirements of the economy is not at all advisable. They (using reserves) are not in the medium-term, forget long-term, interest of any government, not just for India. According to the RBI’s assessment, I think, India should not do it and therefore we are not in favour of it,” Das asserted.

Das also spoke on the impact of recent rate actions by major central banks, the governor said there could be some spillover effects but RBI is confident of maintaining stability of the Indian currency.

“I can say with reasonable confidence that we will be able to maintain the stability of the Indian rupee,” Das said and added that the RBI’s standard policy is to intervene in the foreign exchange market to prevent excessive volatility.

The RBI governor said that the rupee has depreciated by just 0.4 per cent against the US dollar from April 1, 2021 to March 17, 2022. He said the country’s foreign exchange reserves are distributed in various foreign currencies and not just concentrated in just one currency. “We have gold reserves which are also dispersed, partly India and partly outside. So it is quite diversified,” Das stated.