New Delhi: Prime Minister Narendra Modi termed Friday as ‘historic’ the cut in corporate tax rates and asserted that economic announcements made in the last few weeks show that his government is leaving no stone unturned to make India a better place to do business.

“The announcements in the last few weeks clearly demonstrate that the government is leaving no stone unturned to make India a better place to do business, improve opportunities for all sections of society and increase prosperity to make India a USD 5 trillion economy,” Modi said on Twitter.

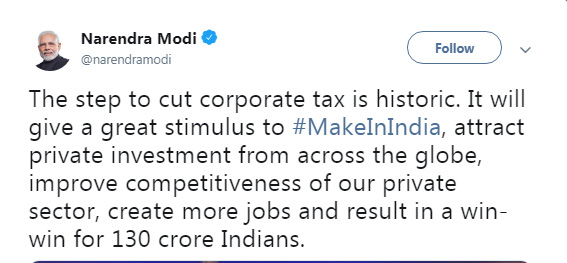

“The step to cut corporate tax is historic. It will give a great stimulus to #MakeInIndia, attract private investment from across the globe, improve competitiveness of our private sector, create more jobs and result in a win-win for 130 crore Indians,” added Modi.

Industry leaders also hailed the government move to slash corporate tax rate for companies. Here is what they had to say.

Anil Agarwal, (executive chairman, Vedanta Resources): The reduction of corporate taxes, including surcharges and cess, will significantly boost the economy and will provide a huge impetus for the manufacturing and infrastructure sector. We are confident this step, in coming days, will boost economic growth so that GDP can attain its true potential of 8-9 per cent.

Rajnish Kumar (chairman, SBI): The large reduction in corporate taxes across the spectrum of all companies is perhaps the boldest reform in the last 28 years! Such a rate cut will boost corporate bottomline, facilitate a reduction in product prices. Additionally, the move to incentivise setting up new manufacturing units in India comes at the most opportune time for foreign companies who could be actively looking for opportunities to invest globally! This move could also materially lead to India effectively integrating with the global supply chain and a boost to Make in India campaign!

Uday Kotak, (CEO, Kotak Mahindra Bank): Reducing corporate tax rate to 25 per cent is big bang reform. It allows Indian companies to compete with lower tax jurisdictions like the US. It signals that our government is committed to economic growth and supports legitimate tax abiding companies. A bold, progressive step forward.

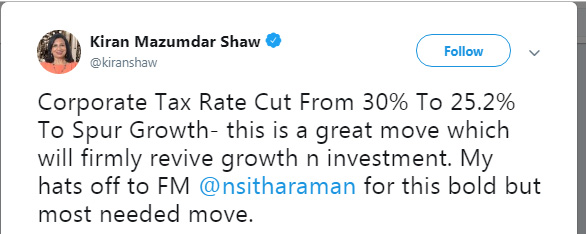

Kiran Mazumdar Shaw, (chairman, Biocon): Corporate tax rate cut from 30 per cent to 25.2 per cent to spur growth. This is a great move which will firmly revive growth and investment. My hats off to Finance Minister for this bold but most needed move.

Gopichand P Hinduja, (Co-chairman, Hinduja Group): The tax reduction is an excellent step that was needed for Indian economy revival and manufacturing sector. It shows government is well seized of the economic challenges facing all of us. I only wish more such steps, which government is already contemplating, could be taken together in one go like tapping NRI investments. This would certainly help put businesses back on track and generate more employment.

Ajay Singh, (CMD Director, SpiceJet): This is a huge step. It will improve sentiment and go a long way in reviving growth, investment and demand. This move, the latest in a series of steps taken by the government to spur growth, demonstrates the ability of the Finance Minister to come up with big solutions to big problems. The Finance Minister has hit the ball out of the Arun Jaitley stadium!

Jairam Ramesh (Congress leader): A headline-itis afflicted, panic-stricken Modi Sarkar (government) has cut corporate tax rates less than three months after a Budget and four months before the next one. This is welcome but it is doubtful whether investment will revive. This does nothing to dispel fear that pervades in India Inc.

Agencies