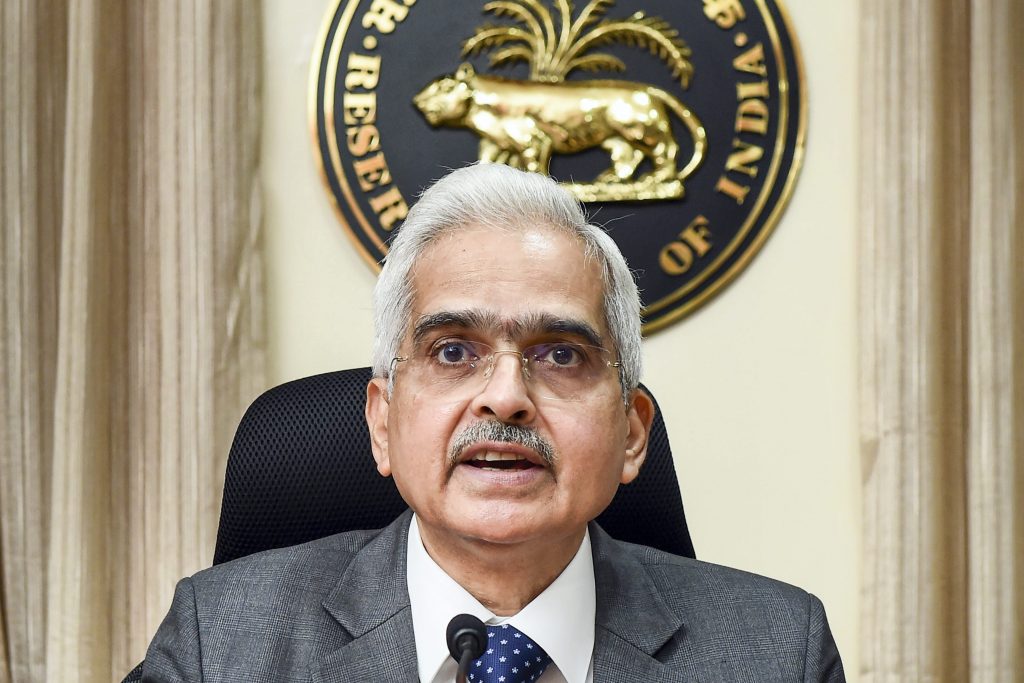

Mumbai: RBI Governor Shaktikanta Das said the retail inflation is “unacceptably and uncomfortably” high and proposed the 50 basis points hike in repo rate at the recent monetary policy review meeting.

The other members of the Monetary Policy Committee (MPC) had expressed similar views, according to the minutes of the meeting released by the Reserve Bank of India (RBI) Friday.

At its meeting from August 3 to 5, MPC decided to increase the benchmark lending rate by 50 basis points to 5.40 per cent with a view to tame inflation.

The sequence of policy measures, Das said, “is expected to strengthen monetary policy credibility and anchor inflation expectations”.

“Our actions would continue to be calibrated, measured and nimble depending upon the unfolding dynamics of inflation and economic activity,” he said.

According to RBI Deputy Governor Michael Debabrata Patra, frontloading of monetary policy actions “can keep inflation expectations firmly anchored, re-align inflation with the target and reduce the medium-term growth sacrifice as it is timed into the recovery underway.”

PTI