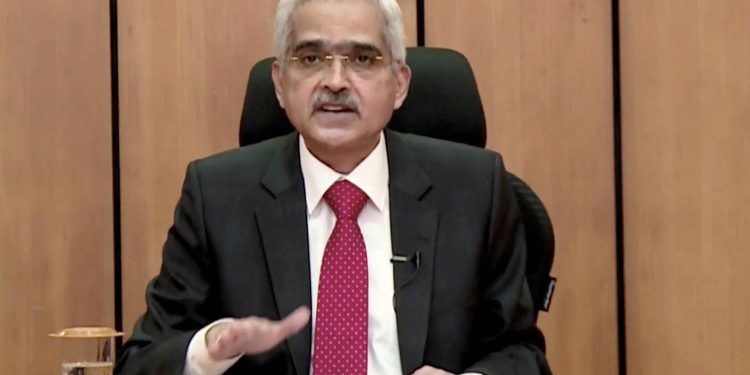

Mumbai: The IPL attracts the entire attention of the nation and Reserve Bank of India (RBI) Governor Shaktikanta Das is not an exception to the rule. The RBI governor chose Friday cricketing terminologies to suggest that some of the worst-hit sectors of the economy can use ‘slog overs’ to rescue the ‘innings’. ‘Open their accounts’ and ‘strike form’ also found a place in the statements of Shaktikanta Das. He used such terms as he shared his views on the coronavirus pandemic-hit economy after the Monetary Policy Committee (MPC) decided to leave key benchmark rate (repo rate) unchanged as well as maintain an accommodative stance.

Das tried to explain the process of recovery for the COVID-19-hit economy. “In my view, it is likely to predominantly be a three-speed recovery, with individual sectors showing varying paces, depending on sector-specific realities,” Das said.

“Sectors that would ‘open their accounts’ the earliest are expected to be those that have shown resilience in the face of the pandemic and are also labour-intensive,” he added.

In this category, Das included agriculture and allied activities; fast-moving consumer goods; two-wheelers, passenger vehicles and tractors; drugs and pharmaceuticals; and electricity generation, especially renewables.

For the governor, the second category of sectors to ‘strike form’ would comprise segments where activity has been normalising gradually.

“The third category of sectors would include the ones which face the ‘slog overs’, but they can rescue the innings. These are sectors that are most severely affected by social distancing and are contact-intensive,” Das remarked.

Das’s use of terminologies popular in the cricketing arena also comes at a time when the Indian Premier League (IPL) is progressing.

India’s gross domestic product (GDP) contracted by a record 23.9 per cent during April-June on account of the impact of the COVID-19 pandemic.

According to the RBI, GDP growth in 2020-21 is expected to be negative at (-)9.5 per cent, with risks tilted to the downside. The growth is likely to be (-)9.8 per cent in the second quarter of 2020-21, (-)5.6 per cent in the third quarter, and 0.5 per cent in the fourth quarter. The GDP growth for the first quarter of 2021-22 has been placed at 20.6 per cent.