Mumbai: Home, automobile and other loans are set to become cheaper after the Reserve Bank of India (RBI) Friday. The RBI cut in interest rates represents a record fifth straight time in almost a decade. With all six members of the Monetary Policy Committee (MPC) voting in favour of a rate cut and for retaining the accommodative stance, the benchmark repurchase rate was cut by 25 basis points to 5.15 per cent. The previous lowest repo rate of 5 per cent was recorded in March 2010.

Following the rate cut, the reverse repo rate was reduced to 4.9 per cent. At the same time, the RBI revised downwards its estimate for GDP growth in the current fiscal to 6.1 per cent from 6.9 per cent it had previously estimated after lower-than-expected 5 per cent growth rate in April-June and no substantial uptick in the following quarter.

The repo rate cut is aimed at pushing consumption up during the ongoing festival season by reducing borrowing costs for home and auto loans, which are now directly linked to this benchmark.

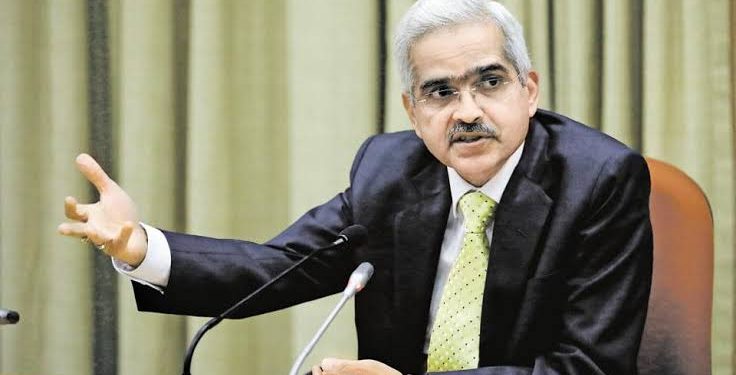

RBI Governor Shaktikanta Das said as long as the growth momentum remains as it is now and growth revives, the MPC will continue with an accommodative stance while ensuring inflation remains within the target.

“RBI will continue accommodative stance as long as it is necessary and growth revives,” he said. In the four previous rate cuts since February, the RBI had cut interest rates by 110 basis points whose transmission to borrowers in form of lower lending rate has “remained staggered and incomplete”, the central bank said in a statement.

Central banks around the world are loosening monetary policy to offset a global slowdown, worsened by US-China trade tensions.

The rate cut by the RBI follows a series of fiscal steps taken by the government over the last six weeks to spur growth. The half-yearly Monetary Policy Report presented along with the policy review suggested that inflation will remain within the target levels till the early part of FY21.