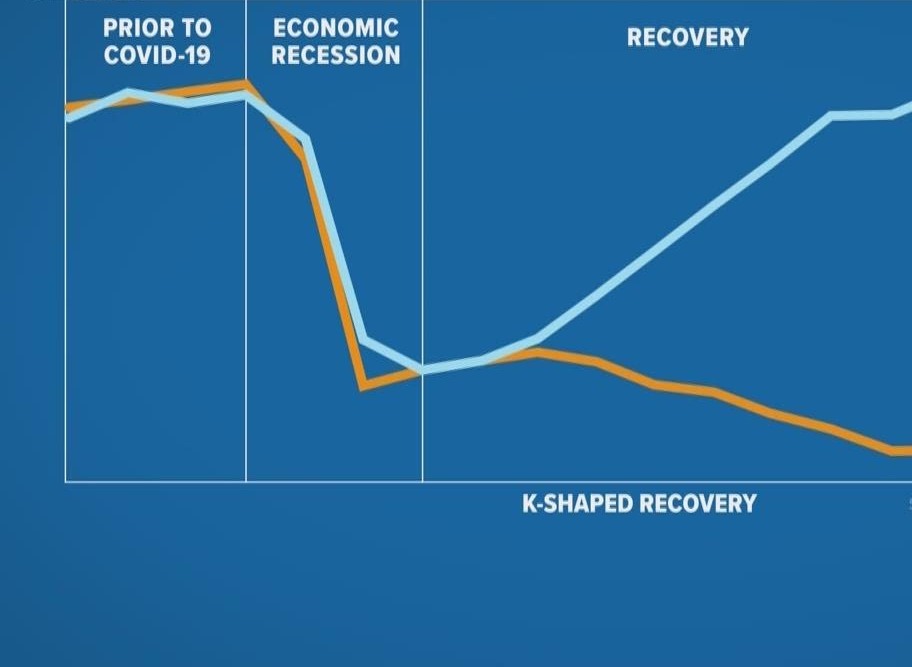

New Delhi: A significant percentage of CFA Institute members believe that a “K-shaped” economic recovery is forming, where different parts of the economy are recovering from the Covid-19 pandemic at different rates, times or magnitudes, as per a survey.

According to the survey of 6,040 global respondents by CFA Institute, the global association of investment professionals, 44 per cent predicted a K-shape recovery, indicating a globally divergent recovery.

The K-shaped recovery marks a distinct shift away from the “hockey-stick shaped” recovery predicted last year, when close to 75 per cent of respondents thought that any upturn would be slow or stagnant in the short term, before picking up in the medium term, the survey said.

“The post-pandemic world is quite visibly a volatile one, and everyone is eyeing the nature of our economic recovery from the same. I believe the most predictable bounce-back would be of a K-shaped nature, wherein different parts of the economy would recover at different rates.

“It is, of course, a certainty that Covid-19 is bound to affect all walks of life and will influence Government policies, Tax regulations, and the entire Indian financial landscape,” said Vidhu Shekhar, CFA, CIPM, Country Head, India, CFA Institute.

The survey was fielded to the global membership of CFA Institute across all regions and jurisdictions where the organisation has the representation. The survey was conducted from March 8 – March 28, 2021, when the effects of the second wave in India had not yet been felt.

In India, 42 per cent of respondents believe that a ‘K-shape’ economic recovery is forming, where different parts of the economy are recovering at different rates, times or magnitudes.

Around 37 per cent of members believe that the economy is on a steady path towards fully recovering and operating at a pre-pandemic pace, while 11 per cent believe that a ‘W-shape’ economic recovery is forming, whereby the economy will see-saw after an initial strong rebound.

The survey further said that 52 per cent of Indian respondents believe that equity markets have recovered too quickly on the impulse of monetary stimulus; they are now out of pace with the real economy and a correction is to be expected within the next 1-3 years.

Globally, China’s recovery is considered to be ahead of most markets; respondents in that country report more optimism for a full recovery in one to three years (39 per cent).

In general, emerging economies appear to be less optimistic about economic recovery. Only 23 per cent, 25 per cent, and 27 per cent of respondents in Latin America and the Caribbean, the Middle East, and Africa, respectively, believe their economy is already on a steady path to recovery.

“They also believe in a higher proportion that a real economic recovery will not occur and that long-term stagnation will ensue,” the survey noted.

PTI