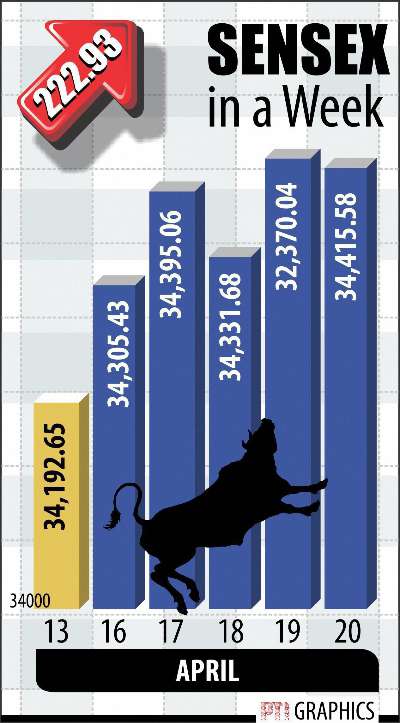

Mumbai: Maintaining its uptrend for the fourth straight week, the benchmark Sensex garnered another 222.93 points to finish at 34,415.58, while the broader Nifty reclaimed to settle above the key 10,500-level at 10,564.05.

Once again market resilience came to the fore as largely volatile range-bound week trade saw the bulls remained intact heartened by Met department forecast of normal monsoon and stellar quarterly results led the bulls to remain intact while enduring the hawkish policy statements from RBI’s minutes.

Starting the week on strong note, the key indices shrugged off geopolitical tensions between US and Russia over Syria, ease in Wholesale Price Inflation (WPI) and rally in stock specifics invigorated the market even as the Sensex marked longest session win not seen since three years during the week.

Despite profit-booking in Oil&Gas, key banks and PSUs following hawkish comments by the Reserve Bank of India in its minutes led fears of early interest rate hike, hurting market sentiment, strength in Metal, IT and Technology stocks kept the bouyant.

Finally, the week belonged to IT sector as investors cheer robust earnings results of key IT major TCS and Mindtree.

The BSE Sensex started the week lower at 33,944.73 and hovered between high of 34,591.81 and low of 33,899.34 before closing the week at 34,415.58, showing a gain of 222.93 or 0.65 per cent. (The Sensex gained 1,596.11 or 4.90 per cent during previous three weeks session)

The Nifty resumed the week at 10,398.30 and traded between 10,594.20 and 10,396.35, the index finally closed at 10,564.05, up 83.45 points, or 0.80 per cent.

In the broader market both midcap and smallcap shares continued to gain slightly.

Buying was led by Metal, IT, FMCG, Teck, Realty, Power, HealthCare, Capital Goods and IPO sectors.

Oil&Gas, Banks, PSUs, Consumer Durables and Auto saw profit-booking.

Meanwhile, foreign portfolio investors (FPIs) and foreign institutional investors (FIIs) sold shares worth Rs 3,033.72 crore during the week, as per Sebi’s record including the provisional figure of April 20, 2018.

The BSE Mid-Cap index rose 121.18 points or 0.73 per cent to settle at 16,798.94. The BSE Small-Cap index rose 196.04 points or 1.09 per cent to settle at 18,178.03.

Among sectoral and industry indices, Metal rose by

4.51 per cent, IT 4.33 per cent, FMCG 4.11 per cent, Teck 3.73 per cent, Realty 3.17 per cent, Power 1.39 per cent, Healthcare 1.05 per cent, Capital Goods 0.29 per cent and IPO 0.25 per cent.

However, Oil&Gas fell by 2.27 per cent, Bankex 1.58 per cent, PSU 1.43 per cent, Consumer Durables 1.21 per cent and Auto 0.07 per cent.

Among the 31-share Sensex pack, 16 stocks rose and remaining 15 stocks fell during the week.

IT major TCS was the top gainer in the Sensex pack.

The stock surged 8.11 per cent to settle at Rs 3,406.40. On a consolidated basis, IT major TCS’ net profit rose 5.81 per cent to Rs 6925 crore on 3.79 per cent increase in net sales to Rs 32075 crore in Q4 March 2018 over Q3 December 2017. Net profit fell 1.81 per cent to Rs 25880 crore on 4.36 per cent increase in net sales to Rs 123104 crore in the year ended March 2018 over the year ended March 2017.

The board of TCS recommended bonus issue of equity shares in the ratio of 1 equity share of Re 1 each for every 1 equity share of Re 1 each.

It was followed by Bharti Artl 6.07 per cent, ITC 5.81 per cent, Power grid 4.94 per cent, HUL 3.94 per cent, Coal India 2.35 per cent, Bajaj Auto 2.10 per cent, NTPC 2.05 per cent, Tata Steel 1.86 per cent and Wipro 1.70 per cent.

Bank shares declined. Axis Bank was the top Sensex loser last week. The stock fell 6.53 per cent to Rs 506.50. It was followed by Tata Motors DVR 5.84 per cent, Tata Motors 5.72 per cent, SBI 3.90 per cent, Indus Ind Bank 2.54 per cent, ICICI Bank 2.17 per cent, Sun Pharma 1.52 per cent, Reliance 1.15 per cent and Maruti 1.11 per cent.

The total turnover during the week on BSE fell to Rs

16,335.71 crore as against last weekend’s level of Rs 17,125.90 crore and NSE rose to 1,48,712.79 crore compared to Rs 1,44,243.82 crore previously.

Wedding season demand boosts gold

Gold extended gains for the second straight week and recaptured the Rs 31,000-mark at the bullion market as local jewellers continued their buying activity to meet ongoing wedding season demand, but a subdued trend overseas capped the gains.

Traders said, besides token purchases by consumers on the auspicious occasion of ‘Akshaya Tritiya’, depreciating rupee against the dollar helped gold prices to trade higher.

The yellow-metal gained 2.86 per cent or Rs 875, while white-metal silver too gained 5.90 per cent or Rs 2,260 in two-weeks.

Silver too topped the Rs 40,000-level on increased

offtake by industrial units and coin makers.

On the global front, Gold futures suffered a second consecutive session of losses, as strength in the dollar and gains in Treasury yields sent prices for the metal lower for the week.

June gold lost USD 10.50, or 0.8 per cent, to settle at USD 1,338.30 an ounce. Though the commodity has mostly traded in a narrow range, the contract was down about 1.6 per cent since hitting a 2-month high of USD 1,360 as recently as April 11.

For the week, gold futures fell by roughly 0.7 per cent, the first such loss in three weeks.

Silver also retreated after starting to play catch-up to gold for much of this week. May silver shed 7.6 cents, or 0.4 per cent, to USD 17.163 an ounce, pulling back from its own 2-month high, hit in the previous session. The contract saw a 3 per cent gain for the week.

In New York Comex trade, gold for June delivery declined to settle at USD 1,338.300 an ounce as compared to last weekend’s close of USD 1,347.90, while May silver contract rose to USD 17.163 an ounce from USD 16.658 earlier.

On the domestic front, standard gold (99.5 purity) commenced higher at Rs 31,080 per 10 grams, from last Friday’s closing level of Rs 30,820 and later surged to a high of Rs 31,415 before closing at Rs 31,315, showing a rise of Rs 495 per 10 grams, or 1.61 per cent.

Similarly, pure gold (99.9 purity) also opened higher at Rs 31,230 per 10 grams, from last Friday’s closing level of Rs 30,970 and later climbed to Rs 31,565 before finishing at Rs 31,465, revealing a gain of Rs 495 per 10 grams, or 1.60 per cent.

Silver ready (.999 fineness) opened positive at Rs

38,810 per kilo from its previous weekend level of Rs 38,480, later rising to a high of Rs 40,325, before ending at Rs 40,160, registering a surge of Rs 1,680 per kilo, or 4.37 per cent.

Boiling crude rattles rupee

The rupee witnessed a free fall – crashing below the significant 66-mark to end at more than one-year low of 66.12 against the US currency after a sudden crisis of confidence rippled through the currency market in mysterious ways.

Surging global crude prices – the big storm against the grim backdrop of geopolitical flare-ups in the Middle East literally battered the forex sentiment over the weekend.

The Indian unit took a hit of 92 paise, or 1.41 per cent against the resurgent dollar – the biggest loser among Asian currencies.

Overall forex mood turned fragile on increasing market conviction of the RBI raising interest rates as early as June despite easing inflation.

Headwinds in the form of widening in trade deficit due to surging crude prices accompanied by portfolio outflows and a more hawkish tone of the Reserve Bank amid unsupportive global factors largely weighed on the rupee front.

Capital outflows too added pressure even as importers rushed to cover their unhedged positions.

The decline in exports and the increased pressure from capital flight all took a toll on the forex stability, fearing a full-blown currency crisis.

The country’s trade deficit hit USD 13.69 billion while exports dipped after a gap of four months in March.

The US Treasury Department added India to its watch list of countries with potentially questionable foreign exchange policies, joining China and four others which impacted overall forex trading mood, traders said.

The bond market also witnessed meltdown, steepening the benchmark 10-year yield curve to 7.72 per cent from 7.43 per cent last weekend.

Global crude prices hit more than three-year high, as falling US crude stockpiles, geopolitical tension and concerns about supply disruptions in key oil-producing nations supported the energy market despite a brief fall after President Donald Trump suggested in a tweet that OPEC is keeping oil prices artificially high.

Brent crude, an international benchmark, was sharply higher at USD 74.06 a barrel after it met resistance at USD 74.15.

Extending its extreme bearish market stance, the rupee opened lower at 65.30 from last weekend’s close of 65.20 at the inter-bank foreign exchange (forex) market.

But later succumbing to immense dollar pressure, the domestic currency accelerated its downside momentum to breach the psychologically important support 66-mark and ended at a fresh 13-week low of 66.12 – a level not seen since March 10, 2017.

Stamping its second-straight weekly fall, the rupee depreciated sharply by 115 paise against the USD.

The RBI, meanwhile, fixed the reference rate for the dollar at 66.0167 and for the euro at 81.4580.

On the global front, the US dollar rebounded from a mid-week crash to finish the week on a firm note after Fed speakers reiterated they were more confident for a faster rate hike for US interest rates amid easing geopolitical tensions.

The dollar index, which measures the greenback’s value against a basket of six major currencies rose to a two-week high of 90.08 against 89.51.

Elsewhere, the pound’s rally came to an abrupt halt as economic data from the UK disappointed expectations and after the Bank of England Governor Mark Carney warned that a rate rise in May was not a forgone conclusion.

Euro ended lower after a long consolidation phase ahead of next week’s European Central Bank’s monetary policy announcement.

In cross-currency trade, the home currency plunged sharply against the euro to finsh at 81.39 from weekend close of 80.31 and slumped against the Japanse yen to end at 61.46 per 100 yens as compared to 60.55.

It also softened against the British pound to settle at 92.98 per pound from last weekend close of 92.97.

In the forward market, premium for dollar displayed a mixed trend owing to lack of market moving factors.

The benchmark six-month forward dollar premium payable for August eased to 95-97 paise from 95.50-97.50 paise, while the far-forward contract maturing in February 2019 rose to 225-227 paise from 216.50-218.50 paise Friday. (PTI)