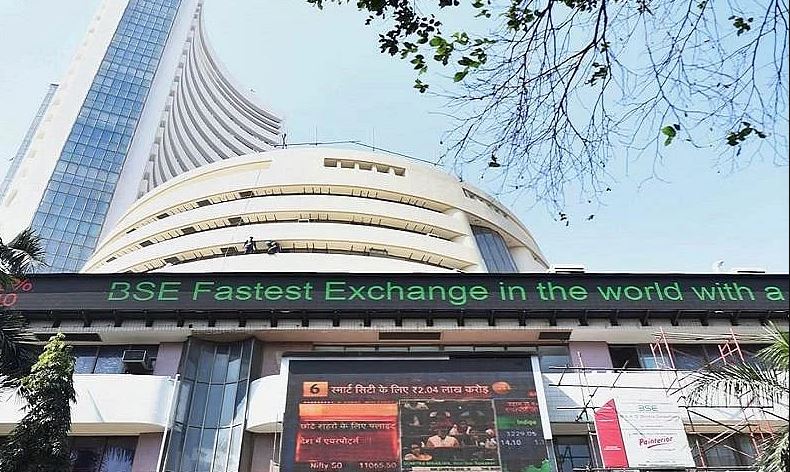

Mumbai: Benchmark stock indices Sensex and Nifty surged nearly 1 per cent Friday, marking their fifth day of rise on the back of fresh foreign fund inflows and gains in bank stocks.

The 30-share BSE Sensex jumped 557.45 points or 0.73 per cent to settle at 76,905.51. During the day, it surged 693.88 points or 0.90 per cent to 77,041.94.

The NSE Nifty climbed 159.75 points or 0.69 per cent to 23,350.40.

Experts said the US Fed has suggested the possibility of two rate cuts this year reigniting the optimism in the domestic market.

From the Sensex pack, NTPC, Bajaj Finance, Kotak Mahindra Bank, Axis Bank, Nestle, Larsen & Toubro, Tata Motors, ICICI Bank, Power Grid and Zomato were among the gainers.

However, Infosys, Tata Steel, Mahindra & Mahindra, Titan and Bajaj Finserv were among the laggards.

Foreign institutional investors (FIIs) bought equities worth Rs 3,239.14 crore Thursday, according to exchange data.

“The domestic market has concluded the week with consistent recovery. The anticipated reduction in risk-free rates, coupled with a correction in the dollar index, is facilitating fund flows back to EMs.

“FIIs, whose selling activity has been waning, are becoming net buyers, driven by dovish signals from the US Fed, which suggest the possibility of two rate cuts this year. This has reignited optimism in the domestic market,” Vinod Nair, Head of Research, at Geojit Financial Services, said.

In Asian markets, Seoul settled in the positive territory while Tokyo, Shanghai and Hong Kong ended lower.

European markets were trading in the negative zone. US markets ended marginally lower Thursday.

Global oil benchmark Brent crude dipped 0.21 per cent to USD 71.85 a barrel.

Thursday, the BSE benchmark jumped 899.01 points or 1.19 per cent to settle at 76,348.06, regaining the 76,000 level. The Nifty surged 283.05 points or 1.24 per cent to reclaim the 23,000-mark to settle at 23,190.65.

IANS