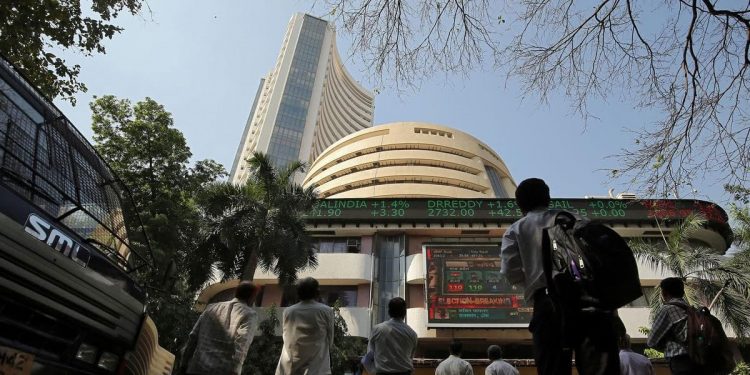

Mumbai: Equity markets began the new financial year with smart gains Friday, with the Sensex rallying over 708 points to recapture the crucial 59,000-mark following gains in index majors HDFC twins and Reliance Industries, along with foreign fund inflows.

On the first day of trading in the new financial year, the BSE barometer rallied 708.18 points or 1.21 per cent to settle at 59,276.69. During the day, it jumped 828.11 points or 1.41 per cent to 59,396.62.

The broader NSE Nifty advanced 205.70 points or 1.18 per cent to settle at 17,670.45.

From the 30-share Sensex pack, NTPC, PowerGrid, IndusInd Bank, State Bank of India, HDFC, Mahindra & Mahindra, HDFC Bank, Bajaj Finance and Axis Bank were among the lead gainers.

In contrast, Tech Mahindra, Sun Pharma, Dr Reddy’s, Titan and Infosys were the laggards.

Elsewhere in Asia, exchanges in Seoul and Tokyo ended lower, while Shanghai and Hong Kong settled in the green. Markets in Europe were mostly trading higher.

Stock exchanges in the US ended on a negative note in the overnight session.

Meanwhile, international oil benchmark Brent crude jumped 0.22 per cent to USD 104.94 per barrel.

Foreign Institutional Investors (FIIs) remained net buyers as they bought shares worth Rs 3,088.73 crore Thursday, according to stock exchange data.

For 2021-22 fiscal, the BSE Sensex jumped 9,059.36 points or 18.29 per cent, while the Nifty rallied 2,774.05 points or 18.88 per cent.

“Indian equity markets gave positive returns this week. Globally too, equity markets remained broadly resilient led by optimism on progress in Russia-Ukraine negotiations. On the other hand, commodities saw some correction from the recent highs. In India, markets saw broad based gains with most sectoral indices giving positive returns.

“Crude oil prices corrected this week and that is some positive for import dependent countries including India,” said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd.

Meanwhile, the production of eight infrastructure sectors expanded by 5.8 per cent in February, the sharpest growth in the last four months, on the back of better output of coal, natural gas, refinery products and cement industries, according to official data released Thursday.