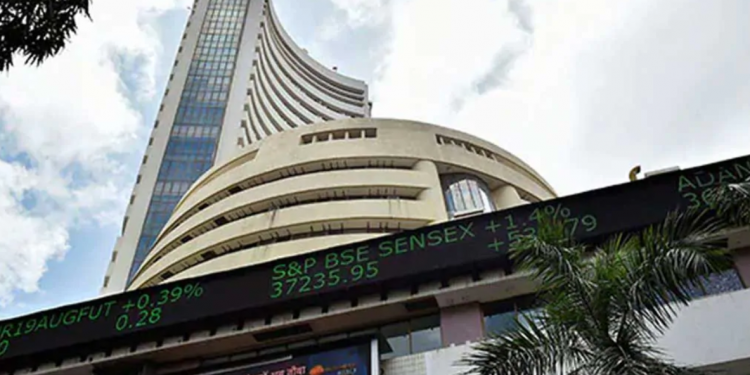

Mumbai: Equity markets tumbled Wednesday after a sharp rebound in the previous trade, with the Sensex falling 496 points in early trade, tracking weak global trends.

Unabated foreign fund outflows and selling in index majors Infosys and Bajaj Finance also played spoilsport.

“The roller coaster ride in markets is set to continue in the near-term. With the 3.95 per cent sell-off yesterday (Tuesday), Nasdaq is now 23 per cent down from its record highs and, therefore, can be said to be in bear market territory.

“The real worry for markets now is a possible sharp global slowdown triggered by the coming aggressive monetary tightening in the US, severe Covid-related lockdowns in China and woes in the Euro Zone caused by the Ukraine war,” said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

The 30-share BSE benchmark was trading 495.77 points lower at 56,860.84. The NSE Nifty dipped 144.15 points to 17,056.65.

From the 30-share Sensex pack, Bajaj Finance, Bajaj Finserv, UltraTech Cement, Infosys, M&M, Wipro, Maruti and Titan were the major laggards in early trade.

In contrast, NTPC, Tata Steel, Reliance Industries, Sun Pharma, Power Grid and HDFC were the gainers.

Asian markets were trading on a mixed note in mid-session deals, with Tokyo and Seoul quoting over 1 per cent lower, while Hong Kong and Shanghai trading marginally higher.

Stocks in the US had ended significantly lower Tuesday.

The Sensex jumped 776.72 points or 1.37 per cent to end at 57,356.61 Tuesday. The Nifty rallied 246.85 points or 1.46 per cent to 17,200.80.

Meanwhile, international oil benchmark Brent crude gained 0.5 per cent to USD 105.42 per barrel.

Foreign institutional investors continued their selling spree, offloading shares worth Rs 1,174.05 crore Tuesday, according to stock exchange data.