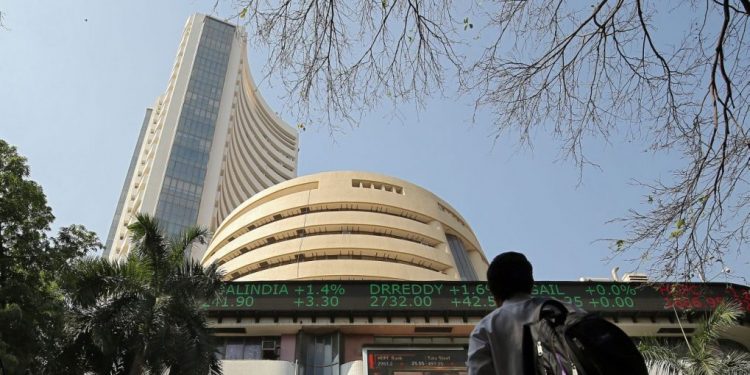

Mumbai: Equity benchmarks bounced back in early trade Thursday after falling sharply in the previous trade, with the Sensex rallying 651 points, following significant jump in US markets and buying in index major Infosys.

The 30-share BSE benchmark was trading 650.9 points higher at 56,319.93. The NSE Nifty also jumped 185.65 points to 16,863.25.

From the Sensex pack, Tech Mahindra, Tata Steel, Infosys, State Bank of India, Kotak Mahindra Bank and M&M were the major gainers in early trade.

In contrast, Nestle and Titan were the laggards.

Markets in Hong Kong were quoting higher.

Stock exchanges in the US surged higher in the overnight trade Wednesday.

The Federal Reserve intensified its fight against the worst inflation in 40 years by raising its benchmark short-term interest rate by a half-percentage point Wednesday.

“US equities rallied, recording the biggest one-day gain since 2020, after Federal Reserve comments suggested that the central bank is unlikely to consider a higher interest-rate hike of 75 basis points in the coming months.

“Moreover, rate hike and balance sheet unwinding quantum was on expected line without any negative surprise, which was already factored in market correction over past few days. It was like a relief rally to some extent,” said Mitul Shah, Head of Research at Reliance Securities.

Meanwhile, domestic equity markets fell sharply Wednesday after the RBI in a surprise move hiked the benchmark lending rate to 4.40 per cent to contain inflation.

The BSE benchmark tumbled 1,306.96 points or 2.29 per cent to settle at 55,669.03 and the Nifty tanked 391.50 points or 2.29 per cent to finish at 16,677.60.

Meanwhile, international oil benchmark Brent crude jumped 0.48 per cent to USD 110.67 per barrel.

Foreign institutional investors offloaded shares worth Rs 3,288.18 crore Wednesday, according to stock exchange data.

“US markets closed higher yesterday (Wednesday) after the Fed announced interest rate hike of 50 bps. Jerome Powell said 75 bps hike is not something that the committee is actively considering. This statement led to market rally,” said Mohit Nigam, Head – PMS, Hem Securities.