New Delhi, Jun 1: India’s manufacturing sector activity eased in May as new work orders rose at a weaker pace, while rising inflationary pressures might prompt the Reserve Bank to hike interest rates, says a monthly survey.

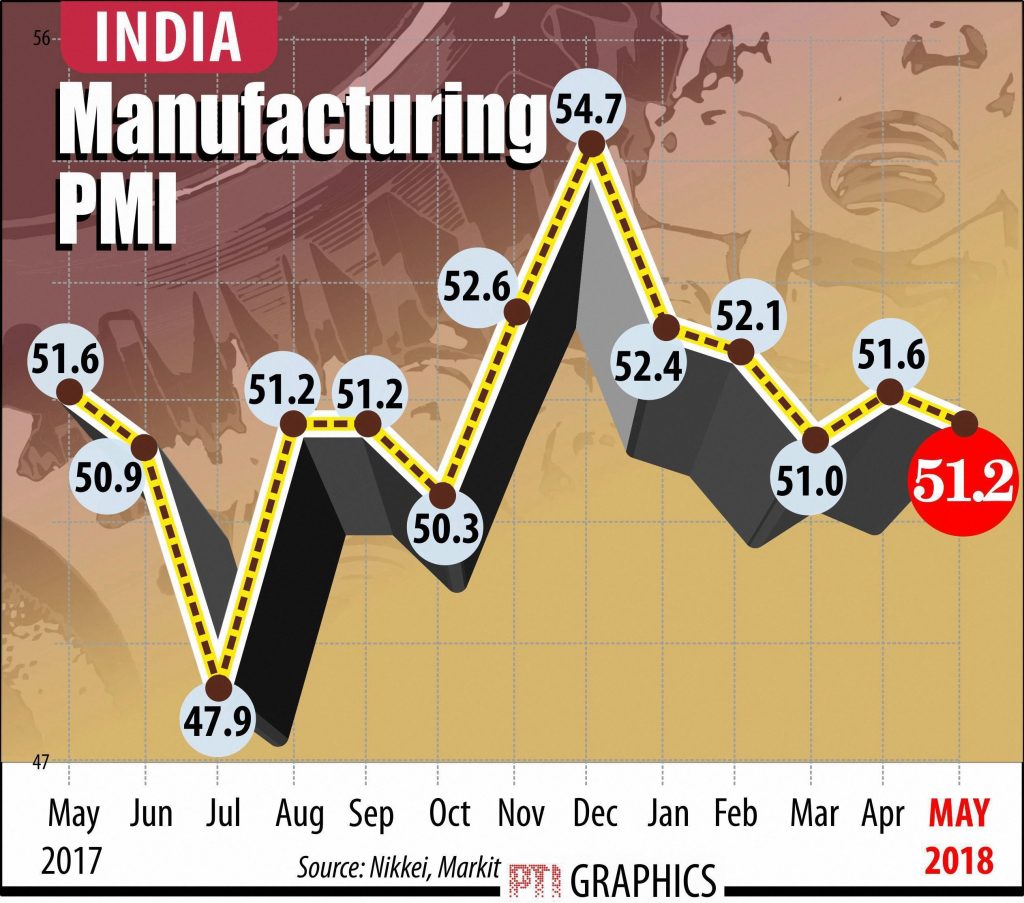

The Nikkei India Manufacturing Purchasing Managers Index (PMI) fell from 51.6 in April to 51.2 in May.

“The latest PMI survey signalled a further, albeit slower, improvement in the health of the manufacturing sector in May. This was reflective of weaker expansions in output, employment and new business,” said Aashna Dodhia, Economist at IHS Markit and author of the report.

This is the tenth consecutive month that the manufacturing PMI remained above the 50-point mark. In PMI parlance, a print above 50 means expansion, while a score below that denotes contraction.

On the prices front, a build-up of inflationary pressures re-emerged as input cost and output inflation was at the strongest since February due to the upswing in global oil prices.

“As a net importer of crude oil, this could potentially destabilise India’s recovery, particularly in private consumption. At the same time, IHS anticipates that high oil prices will lead to a further depreciation of the Indian rupee and a wider current account deficit,” Dodhia said.

Dodhia further noted that in efforts to contain inflation and maintain financial stability, “it is likely that the RBI will raise interest rates over the summer”.

In its first bi-monthly monetary policy for 2018-19 in April, the RBI had left the repo rate unchanged at 6 per cent. The MPC maintained the status quo for the fourth consecutive time since August last year.

Meanwhile, amid reports of greater demand from international markets, Indian manufacturers reported the strongest gain in new export orders since February.