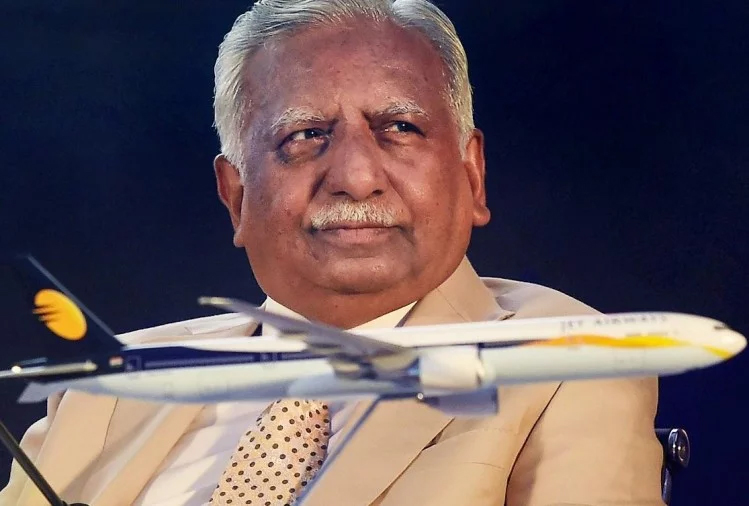

New Delhi: In a new twist to the Jet Airway saga, its erstwhile promoter Naresh Goyal is said to be planning to bid for the airline from which he had to step down as chairman last month only.

This is being seen as a dramatic comeback, when the former chairman will be chalking out plans to submit an expression of interest (EoI) for the distressed Jet fleet.

Official sources said in the absence of strong interest from buyers, Goyal’s possible bid could at least see some concrete movement with a certain roadmap and prevent any chance of its heading towards National Company Law Tribunal (NCLT).

Bankers fear once it goes to the NCLT, recovery of their loans will be late and with haircuts.

Sources in the knowledge of developments said Goyal was expected to submit an EoI on Thursday but it could not be ascertained if he was joining the fray alone or in partnership with private equity players.

The fact that Goyal could still enter the Jet Airways was clear on March 27 when State Bank of India (SBI) chairman Rajnish Kumar said the buyer could be anyone, a financial investor, an airline. There is no legal bar on anyone with a funding and revival plan in place. The option is open for anyone including Naresh Goyal and Etihad to bid for the stake.

Goyal had stepped down as chairman of the airline on March 25 as part of a deal with lenders. Banks were then expected to bring in Rs 1,500 crore in emergency funding, and then look for a new owner. However, banks have transferred just a small part of the funding of few hundred crores and instead called for an EoI from interested bidders looking to take control of the Jet Airways.

While the deadline was set for April 10, SBI Capital, which is overseeing the bidding process, extended it by two days to April 12 owing to poor response.

The SBI is leading the consortium of lenders that has an exposure of Rs 8,500 crore to the cash strapped airline.

On April 10, SBI Capital said it has received some EoIs and has extended the deadline in an attempt to clear the way for more suitors.

Clarifying on the EoI guidelines, the lenders said they have now allowed restructuring of the debt and infusion of funds by way of loans or acquisition of up to 75 per cent stake in the company.

The earlier announced guideline mandated the buyer to “settle” loan obligations of Jet Airways. The troubled airline has a debt of over Rs 8,500 crore.

Apart from Etihad Airways, which holds 24 per cent stake in Jet Airways, other interested players include private equity majors, and sovereign fund National Investment and Infrastructure Fund (NIIF).

—IANS

Jet grounds East,NE ops

Mumbai: Jet Airways Thursday grounded its services to and from the East and Northeast regions and suspended its international operations for a day. The drastic measure was announced after the airline informed the exchanges that it was forced to ground 10 more planes due to non-payment of rentals to the lessors. “Jet Airways flights to London, Amsterdam and Paris from Mumbai, New Delhi and Bangalore scheduled for April 12 are cancelled for operational reasons” said an airline source close to the development. The airline will not operate on the Bengaluru-Amsterdam-Bengaluru route on April 13 as well. Earlier in the day, the airline announced grounding of 10 more planes due to non-payment of rentals to the lessors. “All Jet operations to and from the Eastern and Northeastern regions are suspended. Following this, there are no Jet flights to and from Kolkata, Patna, Guwahati and other airports in the region,” said a travel industry source. When contacted, Jet Airways said its Mumbai-Kolkata, Kolkata-Guwahati and Dehradun-Guwahati via Kolkata stand cancelled for Friday due to “operational reasons.” As of Thursday noon, the airline operated just 14 planes— way down from 123 planes in operations at the peak. “Jet flight 9W 615 Mumbai to Kolkata and 9W 675 from Kolkata to Guwahati on April 12 are cancelled due to operational reasons. “Similarly, 9W 676 from Dehradun to Kolkata via Guwahati has also been cancelled until further notice,” Jet said in a statement, adding refunds are being processed. According to industry sources, the airline now owes more than Rs 3,500 crore to passengers on account of flight cancellations alone. Earlier, in the day the aviation secretary Pradeep Singh Kharola told PTI that the ministry was awaiting a report from the DGCA to decide whether Jet can continue to fly on international routes. The government rules stipulate an airline must have at least 20 planes for operating international operations. Of the 14 aircraft that it is operated till Thursday evening, eight were wide-body B777s (seven) and an A330— generally used for long-haul international operations. The remaining six planes were three B737s, which are largely used for flying on domestic routes besides on short- haul international routes and the rest three are regional ATRs.