Under scanner accused names OPCC president,

Sam Pitroda in the case

Bhubaneswar: The Odisha Pradesh Congress Committee (OPCC) president Niranjan Patnaik and his son Navajyoti Patnaik seem to have fallen into a trap set by themselves way back in 2006. Niranjan was the chairman of Vavasi Telegence Pvt Ltd in which his son Navajyoti became a director.

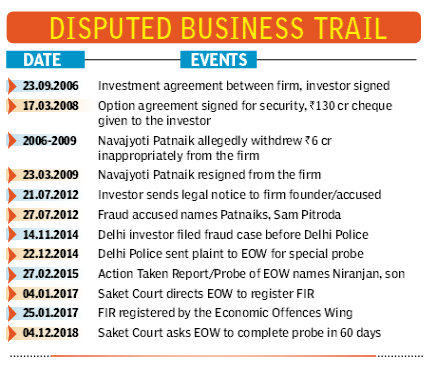

The firm was floated by a Delhi-based couple Farid Arifuddin and his wife Gargi Farid. Allegations have been made that all the promoters together prepared a bunch of forged documents, including a loan sanction letter from the Bank of China, wherein it was claimed that an amount of `17,000 crore had been sanctioned to Vavasi. Based on these fraudulent papers, Niranjan lured KJS Ahluwalia, a Delhi-based investor to invest `32 crore in Vavasi.

Now, Ahluwalia, realising that he had been duped, has filed a plaint with the Delhi Police under Sections of cheating and fraud. This plaint is now under investigation resulting in the Patnaik-son duo falling into soup.

All this at a time when the Congress president Rahul Gandhi has been targeting his rivals on cases of corruption and scams. There are high chances that his tainted party president in Odisha, Niranjan Patnaik and his son could face the music in a fraud case. The Economic Offences Wing (EOW) of the Delhi Police has summoned the OPCC president and his son Navajyoti Patnaik in an economic fraud case, which has been ordered by a Delhi court and is being investigated by the EOW.

According to the case papers, as accessed by Orissa POST, the main accused in the case, Farid Arifuddin, has named Niranjan Patnaik for introducing him to investor KJS Ahluawalia and insisted the latter to invest in Vavasi Telegence Pvt Ltd in 2006. The firm and its owners are now under court radar for furnishing forged papers to get financial aid before getting investments, besides other alleged misappropriations. On the other hand, Niranjan’s son Navajyoti Patnaik has been accused of inappropriately withdrawing a sum of `6 crore from the controversial company.. Junior Patnaik has already been grilled by the Delhi police.

According to the case papers, as accessed by Orissa POST, the main accused in the case, Farid Arifuddin, has named Niranjan Patnaik for introducing him to investor KJS Ahluawalia and insisted the latter to invest in Vavasi Telegence Pvt Ltd in 2006. The firm and its owners are now under court radar for furnishing forged papers to get financial aid before getting investments, besides other alleged misappropriations. On the other hand, Niranjan’s son Navajyoti Patnaik has been accused of inappropriately withdrawing a sum of `6 crore from the controversial company.. Junior Patnaik has already been grilled by the Delhi police.

The Patnaiks have been defending themselves by claiming that they left the company where they were shareholders before 2009. However, documents show most of the controversial transactions of the company occurred during their tenure in Vavasi Telegence when they were among the directors of the company.

According to legal experts, as the investigations are already on under the supervision of Delhi Saket Court, the father-son duo could soon be named as the accused in the case owing to their direct involvement in the company as the decision-makers during the disputed period.

The company was floated by the accused Farid Arifuddin and his spouse around 2006, while Niranjan and Navajyoti were among the directors. After the Delhi-based investor, who invested around Rs 32 crore through 19 cheques between April 14, 2007-January 29, 2009 in the company, got his security deposit cheque bounced from the bank, he moved the Delhi Police and court seeking their intervention. He accused the firm and its owners of cheating and fraud.

The Saket Court had directed the EOW January 4, 2017 to register the case claiming it to be a prima facie case of “cheating” under Section 420 of the IPC and to investigate into the matter. In its latest order dated December 4, 2018, it asked the EOW to complete its investigation within 60 days and file a report to the court before February 6, 2019.

Interestingly, aside from Niranjan and Navajyoti, the main accused in the fraud case has also named Sam Pitroda to have received Rs 9 crore unauthorisedly from the investor violating the agreement norms between the investor and the firm. In his statement to the court, the main accused (founder of the firm), while defending his case against the claims of the investor, had cited backtracking of the investor from the commitments and targeted the Patnaiks and Sam Pitroda.

In a legal reply to the complainant (investor) July 27, 2012, he said, “It was agreed between us that an amount of Rs 45 crore was to be invested by your good self…However out of this, Rs 9.02 crore was sent directly from your account to Sam Pitroda, an Indian citizen living in the US without prior authorisation from VAVASI..” He added, “Furthermore, an amount of Rs 6 crore was inappropriately drawn from the account between 2005-2009 by Navajyoti Patnaik, then director of the company and your investment was also made on the behest of Niranjan Patnaik…”

Moreover, the Action Taken Report and probe report of the EOW claimed May 5, 2015 that as per their investigations it was revealed that the investor was introduced to the firm through Niranjan Patnaik and he invested at the behest of Niranjan and Navajyoti. The Patnaiks, meanwhile, in their arguments in the court, have accused the investigating teams of blindly believing the words of the accused and not conducting a fair probe.

The prime investor in this company is KJS Ahluwalia, a prominent miner from Odisha. Niranjan is also directly related to the owners of Indrani Patnaik mines. The Patnaik’s mine company premises were recently searched by the Income Tax authorities on grounds of tax default. Ahluwalia and Patnaiks have some of the largest and best mines in this state.