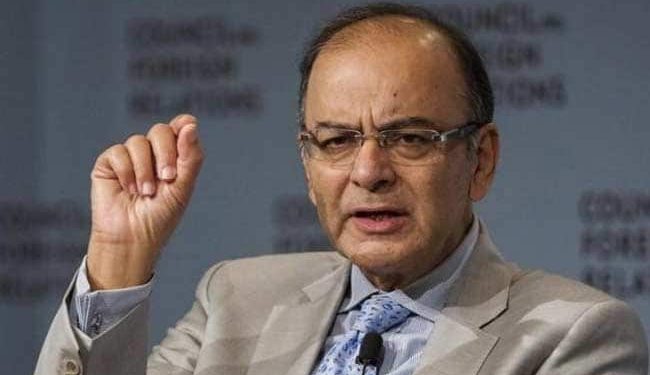

New Delhi: In a new year bonanza to 18 lakh central government employees, Finance Minister Arun Jaitley Monday said the Centre has decided to enhance its contribution towards their pension corpus to 14 per cent from existing 10 per cent and also made entire withdrawal amount tax free at the time of retirement.

The individual contributions, which will continue to be capped at a maximum of 10 per cent of the basic salary, will be exempt from taxable income under Section 80 C of Income Tax Act. The National Pension System (NPS) is a government-sponsored pension scheme that was launched in January 2004 for government employees. However, in 2009, it was opened to all sections.

Based on the recommendations of Committee of Secretaries (CoS), the Cabinet last week decided to increase its contribution to 14 per cent for the central government employees under the NPS, he said.

“Some changes have been made in the larger interest of employees…the corpus would now be 24 per cent from 20 per cent. Of this 14 per cent would be contributed by the government and the remaining 10 per cent by the employees,” he said.

Another important change, he said, tax exemption limit for lump sum withdrawal on exit has been enhanced to 60 per cent, making entire withdrawal now exempt from income tax.

At present, 40 per cent of the total accumulated corpus utilised for purchase of annuity is already tax exempted, and of 60 per cent of the accumulated corpus withdrawn by the NPS subscriber at the time of retirement, 40 per cent is tax exempt and balance 20 per cent is taxable. This tax exemption on withdrawal is for all sections of employees.

The exact date, after changes made in the Finance Bill, will be notified soon, he said, adding normally the practice is that such changes are made from the new financial year. According to sources, the government can start enhanced contribution beginning January but tax benefit would be available from next financial year.

Taking into account 18 lakh employees, the additional burden on the government due to enhanced contribution would be Rs 2,840 crore in 2019-20, the Finance Minister said.