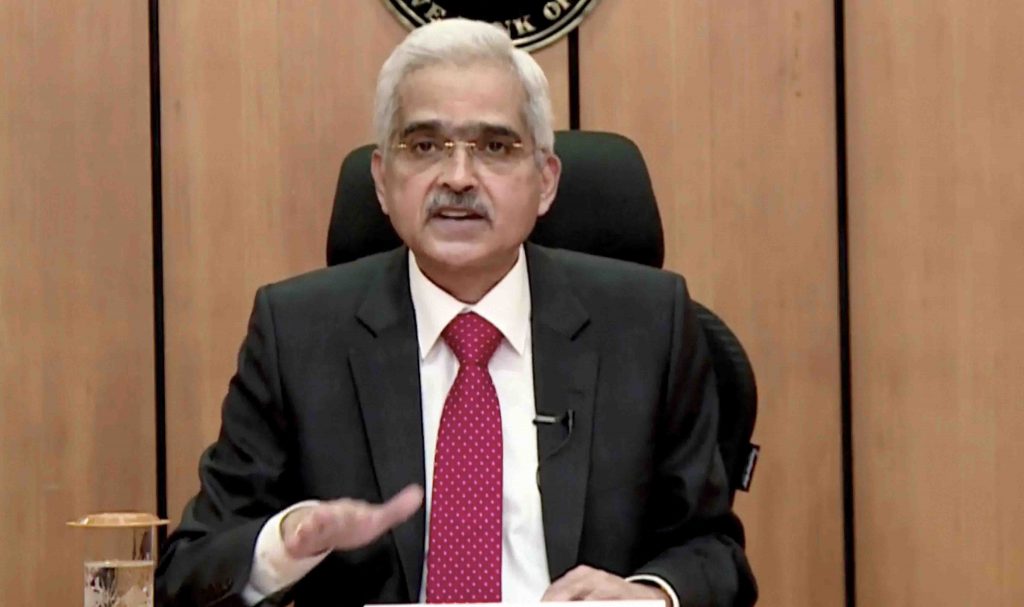

Mumbai: Amid flak faced by the RBI for missing inflation target, Governor Shaktikanta Das Wednesday defended its policies saying the economy would have taken a “complete downward turn” if it had started to tighten rates earlier.

Das said the Indian economy is being looked at as a story of resilience and optimism by the world and the inflation is now expected to moderate.

Acknowledging that the central bank has missed its primary target as inflation has consistently overshot, Das said there is a need for appreciating the counterfactual aspect as well, and think about the impact of premature tightening which would have hurt recovery.

“It (tightening earlier) would have been very costly for the economy. It would have been very costly for the citizens of this country. We would have paid a high cost,” he said.

“We prevented a complete downward turn of our economy,” Das said, adding that RBI did not want to upset the recovery process and was guiding the economy towards a safe landing.

During the pandemic, the RBI utilised flexibility in the monetary policy framework to tolerate a slightly higher inflation which was within the target range of 2-6 per cent, to ensure that overall economy remained resilient and financial stability was maintained, Das said.

He said the economy bounced back in FY22 and FY23 after contracting in the pandemic-affected FY21, and is also expected to sustain in FY24.

It can be noted that some critics have questioned the delay in rate tightening, which began in May this year with an off-cycle meeting of the rate-setting panel, saying RBI should have acted earlier in the face of high inflation.

Seeking to address the critique of RBI being behind the curve, Das said the debate on this topic is over and presented a chronology to illustrate how the Russian invasion of Ukraine which led to commodity price spike and impact on financial markets said all estimates were wrong.

Till the war started, the RBI was expecting headline inflation to come at 4.3 per cent while the analysts were forecasting it to be above 5 per cent, but the war that started on February 24, led to all estimates going wrong.

He said the RBI’s rate setting panel will be meeting on Thursday to discuss and formulate a response to the government for a failure to meet the inflation target. Its reply will focus on the reasons that led to inflation staying above 6 per cent for nine consecutive months, when it sees coming back into the 2-6 per cent band and the measures that will be taken, Das said.

Amid criticism for its decision not to make the communication public, Das said there is no law which gives him the privilege, luxury and authority to go public with the letter and asserted that keeping it private does not compromise transparency in any way.

On the growth front, he said India’s recovery has been more broad-based, courtesy timely and targeted fiscal, monetary and regulatory policies.

A study of 70 high-frequency indicators by the RBI is pointing towards a healthy private consumption, especially in the urban areas, Das said, pointing to the purchases that happened during the recently concluded festivities.

Contact-intensive services have continued to make a smart rebound, Das said, adding that retail sales of white goods and fast-moving consumer goods have also improved.

The external demand was classified as a “weak spot” by the RBI Governor because of the overall headwinds faced in major markets.

In remarks that come hours ahead of the US Fed’s decision on rates, Das said the American central bank cannot keep tightening endlessly and added that once the hikes stop, capital flows will resume to countries like India.

He asked people not to look at currency depreciation from an emotional perspective, asserting that there has been an orderly depreciation of the domestic currency.

Das termed the launch of the central bank digital currency (CBDC) Tuesday as a major milestone in the history of currency in the country and added that it will lead a major transformation in the way we do business.

Trials on the retail CBDC front will start this month itself and the complete CBDC will be a reality soon, Das said, choosing not to give a timeline on the same.

After piloting a project for quickly disbursed digital loans for the farm sector in a few pockets, Das said the country will have similar lending for small businesses in 2023.

Das asked banks to invest more in technologies and added that branch banking as a model will stay for long.