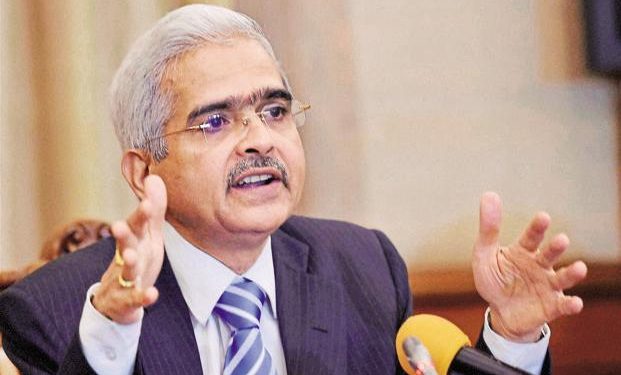

Mumbai: After surprisingly holding the rates, Reserve Bank Governor Shaktikanta Das said Thursday that the central bank cannot ‘mechanically’ keep cutting interest rates every time.

Das said that RBI will wait for the impact of the coordinated measures taken by the government and the RBI over the past few months to push growth to play out before taking a call on rates.

Official data showed growth has fallen to an over six-year low at 4.5 per cent in the second quarter, and the RBI also sharply cut its FY20 estimate to five per cent-a full 110 bps from its October revision, which again was a 90 bps downward revision from the August assessment.

The sharp decline in growth had many analysts assuming the RBI will deliver a rate cut Thursday. However, the Monetary Policy Committee let the repo rate remain at 5.15 per cent and it came as a surprise to many economists.

“The timing of rate cuts is very important in order to optimize its impact,” Das said. “The RBI cannot ‘mechanically’ keep cutting interest rates every time,” he added.

Das also pointed towards a line in the monetary policy committee resolution, which makes it ‘explicitly’ clear that there is a scope for further rate cuts. He said that there are green-shoots in the economy, but it is too early to take a call on their sustainability.

The RBI Governor, however, asserted that the recent measures initiated by the government will help reviving sentiment and spur domestic demand, which is being blamed as prime reasons for the slowdown.

Das also said that credit flow from banks to the battered non-bank lenders is improving of late and that the central bank will not allow any large shadow bank to collapse.

Without naming DHFL, which has been sent for bankruptcy, Das said the regulator is best placed to assess a non-banking lender and termed the move to take such an entity to the NCLT as a ‘pragmatic’ step.

Das also informed that the top-50 NBFCs are being regularly monitored by the RBI as it has a fairly good idea on which of the NBFCs are ‘vulnerable’ and made it clear that ‘RBI will not allow any large NBFC to collapse’, He stated that RBI has been taking a slew of measures to increase credit flow from banks to NBFCs, and said the steps taken so far have had the desired impact but did not offer any numbers.

Agencies