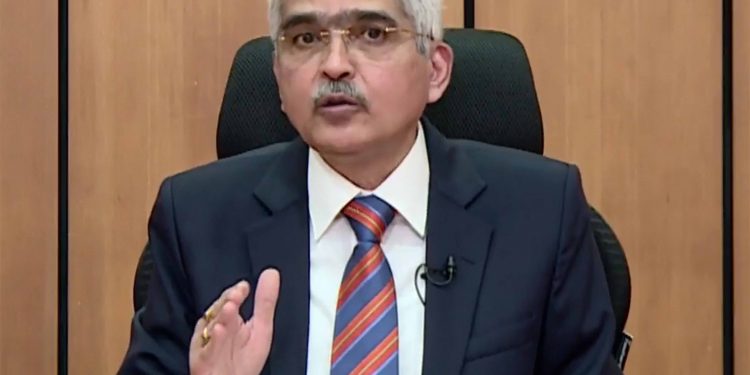

New Delhi: Issues concerning cyber security and data protection must be addressed to gain confidence of the excluded section in use of technology, which is necessary for promoting financial inclusion, Reserve Bank of India (RBI) Governor Shaktikanta Das said Wednesday. “Technology, though being a great enabler, can also lead to exclusion of certain segments of society,” Shaktikanta Das said in his keynote address at a webinar on ‘Investing in Investor Education in India: Priorities for Action’. The webinar was organised by the NCAER.

The RBI Governor added that it was imperative to build trust in formal financial services among the hitherto excluded population.

“Adequate safeguards need to be reinforced to address issues of cyber security, data confidentiality, mis-selling, customer protection and grievance redress through appropriate financial education and awareness. These cast great responsibility on financial education providers,” emphasized Das.

Financial inclusion in India, he said, is poised to grow exponentially with digital savvy millennials joining the workforce, social media blurring the urban-rural divide and technology shaping the policy interventions.

For harnessing the near universal reach of bank accounts across the length and breadth of India, there needs to be greater focus on penetration of sustainable credit, investment, insurance and pension products by addressing demand side constraints with enhanced customer protection, Das pointed out.

The interventions in financial education would have to be customised in local language and local settings keeping the different target audience in mind, he said. The scaling up of Centre for Financial Literacy (CFL) projects across India at the block level would be the cornerstone of community-led participatory approaches in the journey towards greater financial literacy, added Das.

The RBI Governor also stressed that in a large country like India with an aspiring population, financial education cannot remain just the responsibility of financial sector regulators.

This aspect has been highlighted in the National Strategy for Financial Education (NSFE 2020-2025) document which recommends a multi-stakeholder led approach to achieve financial wellbeing of all.

“Going forward, increasingly, educational institutions, industry bodies and other stakeholders like think tanks, research institutions should come forward to shoulder the responsibility of increasing financial literacy through appropriate awareness campaigns,” Das said.

Financial inclusion initiatives in India started in the aftermath of first All India Rural Credit Survey in 1954 with promotion of cooperatives.