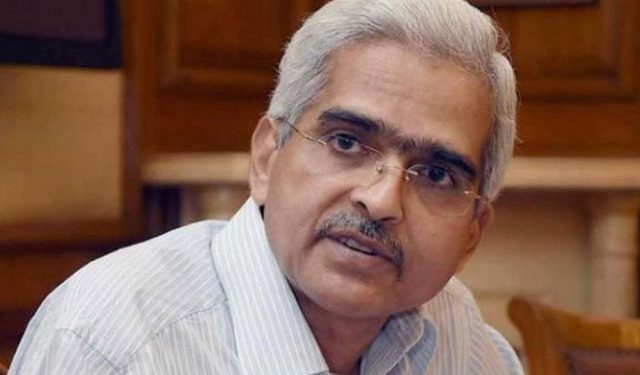

New Delhi: RBI Governor Shaktikanta Das will meet financial technology (fintech) companies this week to understand the issues affecting the growth of the sector and will issue guidelines on the regulatory “sandbox” for the sector in the next two months, Das said Monday.

The fintech sector comprises of mobile payments, money transfers, loans, crowdfunding, asset management, among many others.

“RBI has given nod to seven purely digital loan companies which are basically NBFCs (non-banking finance companies) to commence operartions but quite a few of them have not commenced operations and there are other kinds of licences which have also been given where operations have not taken off by everyone, while some of them have not taken off in the expected way, ” Das said, inaugurating the Fintech Conclave 2019 here organised by Niti Aayog

“I will be meeting them later part of this week and we will have consultations with them to find out what are the impendiments, if any, and problems”, he said.

The Governor said the RBI will come out with the necessary regulatory sandbox for the sector in 2 months, which would ensure regulatory compliance and security checks for financial operations.

Addressing the conclave, Economic Affairs Secretary Subhas Chandra Garg said that financial data should not be treated as sensitive data, and the country would miss out on the fintech revolution if data protections laws are not aligned.

India is now the world’s second biggest fintech hub, trailing only the US, with 2,035 startups operating in the sector, according to the India Fintech Report 2019. Mumbai and Bengaluru are the leading startup hubs in the country.

IANS