Mumbai: The Reserve Bank of India (RBI) Wednesday hiked key benchmark policy rate by 25 basis points to 6.5 percent, citing sticky core inflation.

This is the sixth time interest rate has been hiked by the Reserve Bank of India since May last year, taking the total quantum of hike to 250 basis points.

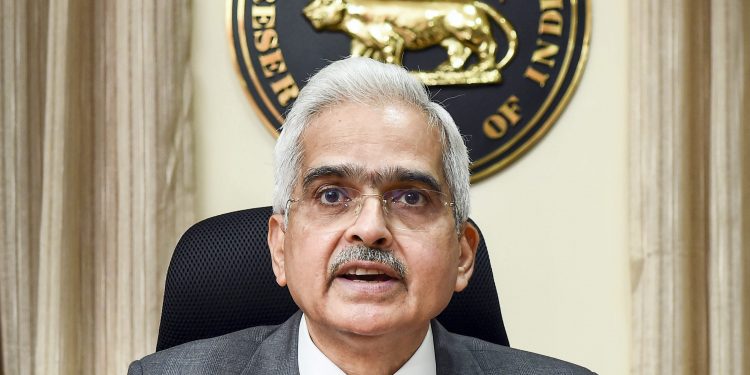

Announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) by a majority decided to raise the policy repo rate by 25 basis points and keep a ‘strong vigil’ on inflation outlook.

“Policy rate at 6.5 percent still trails the pre-pandemic level,” Das said, adding that core inflation will remain sticky.

Core inflation generally refers to inflation in manufactured goods.

The governor said the inflation will moderate in the next fiscal but remain above the 4 percent level. The RBI is mandated to keep inflation at 4 percent with a margin of 2 percent on either side.

For the next fiscal, the RBI projected a growth rate of 6.4 percent. In the latest Economic Survey of the finance ministry, the growth projection was 6-6.8 percent for 2023-24.

According to Das, retail inflation will average 6.5 percent in the current fiscal and moderate to 5.3 percent in 2023-24.

Indian economy has remained resilient demand global headwinds, Das said.

PTI